39 treasury bill coupon rate

Coupon Interest and Yield for eTBs - australiangovernmentbonds The Coupon Interest Rate on a Treasury Bond is set when the bond is first issued by the Australian Government, and remains fixed for the life of the bond. For example, a Treasury Bond with a 5% Coupon Interest Rate will pay investors $5 a year per $100 Face Value amount in instalments of $2.50 every six months. U.S. 5 Year Treasury Note Overview - MarketWatch Five-year Treasury yield rises above 2.2%, surpassing 10-year yield's level and inverting fresh part of the curve after Fed's decision. Mar. 16, 2022 at 2:55 p.m. ET by Vivien Lou Chen.

United States Rates & Bonds - Bloomberg Get updated data about US Treasuries. Find information on government bonds yields, muni bonds and interest rates in the USA.

Treasury bill coupon rate

Resource Center | U.S. Department of the Treasury Download the daily XML files and XSD schema for all data sets. Download CSV. Select type of Interest Rate Data. Daily Treasury Par Yield Curve Rates Daily Treasury Bill Rates Daily Treasury Long-Term Rates Daily Treasury Par Real Yield Curve Rates Daily Treasury Real Long-Term Rates. Select Time Period. U.S. 2 Year Treasury Note Overview - MarketWatch 2-year Treasury rate hits lowest level since March even after a surge in U.S. wholesale prices Apr. 13, 2022 at 4:11 p.m. ET by William Watts 2-year Treasury yield up 1.3 basis points at 2.397% Treasury Bills (T-Bills) Definition Dec 12, 2021 · What Is a Treasury Bill (T-Bill)? A Treasury Bill (T-Bill) is a short-term U.S. government debt obligation backed by the Treasury Department with a maturity of one year or less. Treasury bills are ...

Treasury bill coupon rate. United States Treasury Bills: 26-week - High rate | Moody ... Treasury Bills: 26-week - High rate for United States from U.S. Bureau of Public Debt for the Treasury auctions - 13- and 26-week (91- and 182-day) T-Bills release. This page provides forecast and historical data, charts, statistics, news and updates for United States Treasury Bills: 26-week - High rate. 91 Day T Bill Treasury Rate - Bankrate The yield on 91-day Treasury bills is the average discount rate. How it's used: The rate is used as an index for various variable rate loans, particularly Stafford and PLUS education loans. Lenders... Treasury Rates, Interest Rates, Yields - Barchart.com Treasury Rates. This table lists the major interest rates for US Treasury Bills and shows how these rates have moved over the last 1, 3, 6, and 12 months. Click on any Rate to view a detailed quote. Treasury bills, notes and bonds are sold by the U.S. Treasury Department. NSDP Display - Reserve Bank of India April 14, 2015 Dear All Welcome to the refurbished site of the Reserve Bank of India. The two most important features of the site are: One, in addition to the default site, the refurbished site also has all the information bifurcated functionwise; two, a much improved search - well, at least we think so but you be the judge.

What are coupons in treasury bills/bonds? - Quora The "coupon" on a T-note or T-bond is the contractual rate as a percentage of par that will be paid to the holder one-half each time twice a year. A 6% treasury note due November 15, 20xx will pay the holder $30 per $1,000 face value of the note on May and November 15th of each year until the due date. 49 views Answer requested by Hussain Sajwani Treasury Bills - Guide to Understanding How T-Bills Work In this case, the discount rate is 5% of the face value. Get T-Bill rates directly from the US Treasury website. How to Purchase Treasury Bills Treasury bills can be purchased in the following three ways: 1. Non-competitive bid In a non-competitive bid, the investor agrees to accept the discount rate determined at auction. Treasury Bills (T-Bills) - What They Are & How to Buy for ... The Treasury auctions T-bills to investors, who purchase the security at a discount to the face value. For example, an investor may purchase a bill with a $1,000 face value and a six-month maturity at a price of $950. In six months, when the investment matures, the investor receives $1,000, producing $50 in profit. Covid-19 Economic Relief | U.S. Department of the Treasury Latest Programs and Updates American Rescue Plan Six Month In total, the Treasury Department is responsible for managing over $1 trillion in American Rescue Plan programs and tax credits. Read about the impact of the first six months of the American Rescue Plan programs in the impact report. Economic Impact Payments The Treasury Department, the Office of Fiscal Service, and the Internal ...

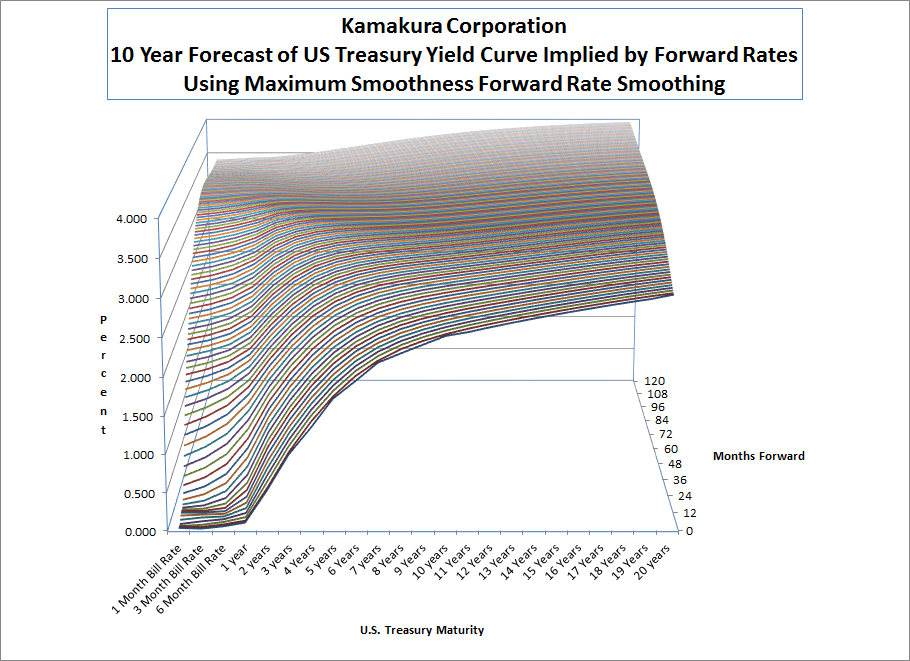

1 Year Treasury Rate - 54 Year Historical Chart | MacroTrends Interactive chart showing the daily 1 year treasury yield back to 1962. The values shown are daily data published by the Federal Reserve Board based on the average yield of a range of Treasury securities, all adjusted to the equivalent of a one-year maturity. The current 1 year treasury yield as of April 22, 2022 is 2.06%. Treasury Coupon Issues | U.S. Department of the Treasury Nominal TNC Data TNC Treasury Yield Curve Spot Rates, Monthly Average: 1976-1977TNC Treasury Yield Curve Spot Rates, Monthly Average: 1978-1982TNC Treasury Yield Curve Spot Rates, Monthly Average: 1983-1987TNC Treasury Yield Curve Spot Rates, Monthly Average: 1988-1992TNC Treasury Yield Curve Spot Rates, Monthly Average: 1993-1997TNC Treasury Yield Curve Spot Rates, Monthly Average: 1998 ... Individual - Treasury Bills In Depth Treasury bills, or T-bills, are typically issued at a discount from the par amount (also called face value). For example, if you buy a $1,000 bill at a price per $100 of $99.986111, then you would pay $999.86 ($1,000 x .99986111 = $999.86111).* When the bill matures, you would be paid its face value, $1,000. How Are Treasury Bill Interest Rates Determined? The interest rate comes from the spread between the discounted purchase price and the face value redemption price. 3 For example, suppose an investor purchases a 52-week T-bill with a face value...

Treasury Bills - Types, Features and Advantages of ... Yield Rate on Treasury Bills The percentage of yield generated from a treasury bill can be calculated through the following formula - Y = (100-P)/P x 365/D x 100 Where Y = Return per cent P = Discounted price at which a security is purchased, and D = Tenure of a bill Let us consider a treasury bills example for better understanding.

TMUBMUSD06M | U.S. 6 Month Treasury Bill Overview ... TMUBMUSD06M | A complete U.S. 6 Month Treasury Bill bond overview by MarketWatch. View the latest bond prices, bond market news and bond rates.

US Treasury Bonds - Fidelity The coupon rate is fixed at the time of issuance and is paid every six months. Other Treasury securities, such as Treasury bills (which have maturities of one year or less) or zero-coupon bonds, do not pay a regular coupon. Instead, they are sold at a discount to their face (or par) value; investors receive the full face value at maturity.

13 Week Treasury Bill (^IRX) Historical Data - Yahoo Finance Get historical data for the 13 Week Treasury Bill (^IRX) on Yahoo Finance. View and download daily, weekly or monthly data to help your investment decisions.

Understanding Treasury Bond Interest Rates | Bankrate Imagine a 30-year U.S. Treasury Bond is paying around a 1.25 percent coupon rate. That means the bond will pay $12.50 per year for every $1,000 in face value (par value) that you own. The ...

Price, Yield and Rate Calculations for a Treasury Bill ... Calculate Coupon Equivalent Yield In order to calculate the Coupon Equivalent Yield on a Treasury Bill you must first solve for the intermediate variables in the equation. In this formula they are addressed as: a, b, and c. 364 0.25 (4) a = Calculate Coupon Equivalent Yield For bills of not more than one half-year to maturity

US T-Bill Calculator | Good Calculators For example, if you were to buy a T-Bill of $10,000 for $9,900 over a period of 13 weeks then you would have a profit of $100 and a rate of return of 1.01% US Treasury Bills Calculator Face Value of Treasury Bill, $: 1000.00 5000.00 10000.00 25000.00 50000.00 100000.00 1000000.00

US Treasury Bonds Rates - Yahoo Finance Bonds Center - Learn the basics of bond investing, get current quotes, news, commentary and more.

How Often Does The Treasury Bill Rate Change? - Inflation ... In fact, on average Treasury Bill rates have a yield of around 4.5%. This yield is composed of the coupon rate, which is the interest payment made to bill owners every six months, and the difference between the face value of the bill and what it was sold for, called the discount.

Treasury Bills (T-Bills) - Meaning, Examples, Calculations For example, The US Federal Treasury Department issued 52week T-Bills at a discounted rate of $97 per bill at face value of $100. An investor purchases 10 T-Bills at a competitive bid price of $97 per bill and invests a total of $970. After 52 weeks, the T bills matured.

5 Year Treasury Rate - YCharts Apr 22, 2022 · The 5 year treasury yield is included on the longer end of the yield curve. Historically, the 5 Year treasury yield reached as high as 16.27% in 1981, as the Federal Reserve was aggressively raising benchmark rates in an effort to contain inflation. 5 Year Treasury Rate is at 2.81%, compared to 2.79% the previous market day and 0.88% last year.

Reserve Bank of India Coupon on this security will be paid half-yearly at 4.12% (half yearly payment being half of the annual coupon of 8.24%) of the face value on October 22 and April 22 of each year. ii) Floating Rate Bonds (FRB) - FRBs are securities which do not have a fixed coupon rate.

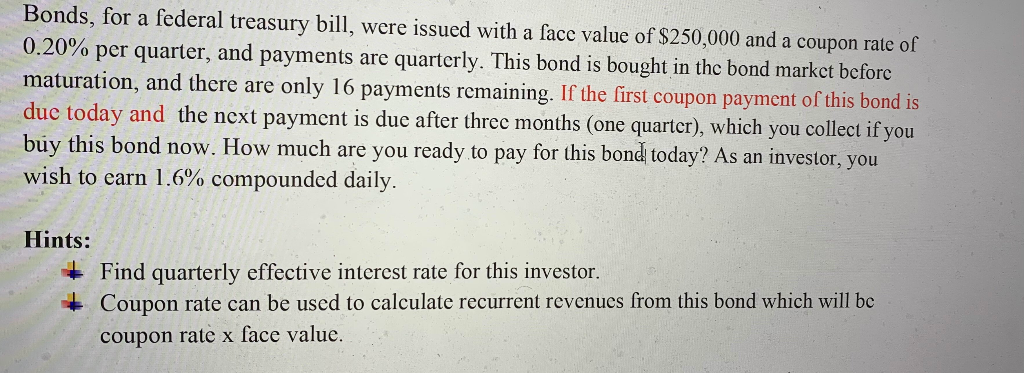

Understanding Coupon Rate and Yield to Maturity of Bonds ... The frequency of payment depends on the type of fixed income security. In the above example, a Retail Treasury Bill (RTB) pays coupons quarterly. To translate this to quarterly payment, first, multiply the coupon rate net of 20% final withholding taxes by the face value (1.900% x 1,000,000). Then, divide the resulting annual amount by 4.

Treasury Bills (T-Bills) Definition Dec 12, 2021 · What Is a Treasury Bill (T-Bill)? A Treasury Bill (T-Bill) is a short-term U.S. government debt obligation backed by the Treasury Department with a maturity of one year or less. Treasury bills are ...

U.S. 2 Year Treasury Note Overview - MarketWatch 2-year Treasury rate hits lowest level since March even after a surge in U.S. wholesale prices Apr. 13, 2022 at 4:11 p.m. ET by William Watts 2-year Treasury yield up 1.3 basis points at 2.397%

Post a Comment for "39 treasury bill coupon rate"