40 present value formula coupon bond

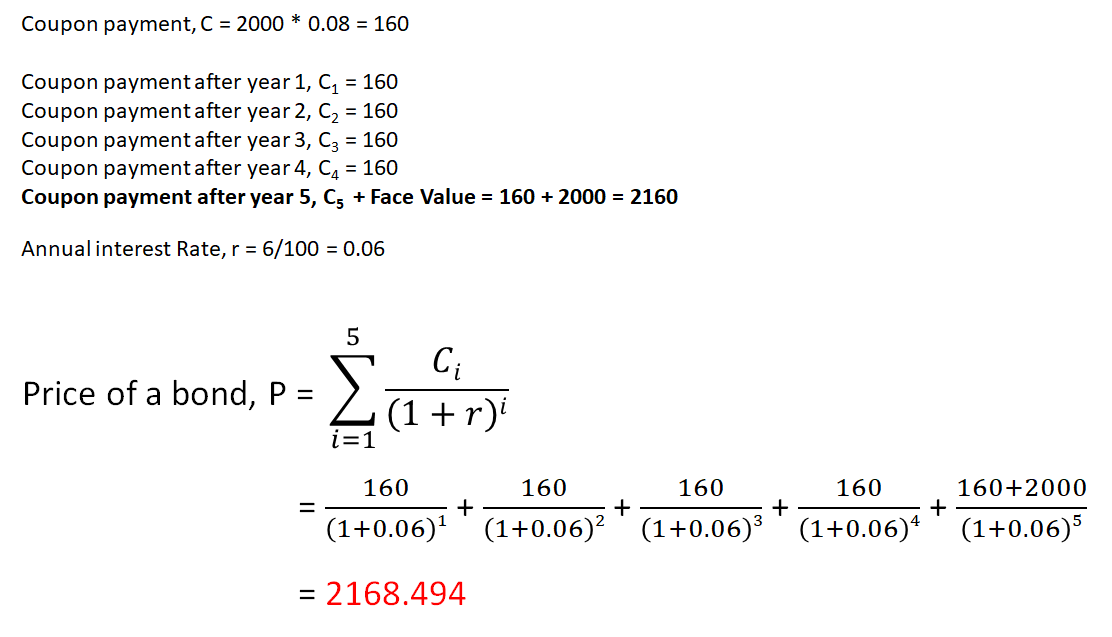

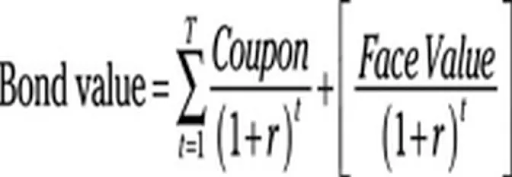

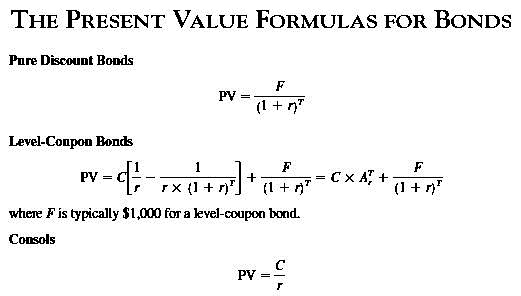

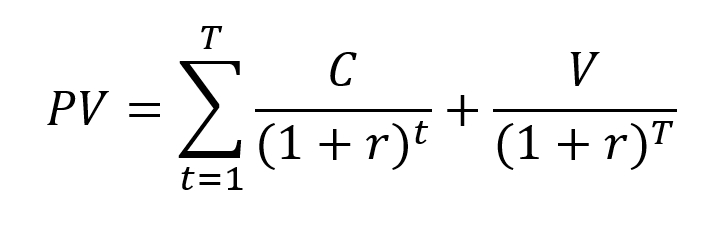

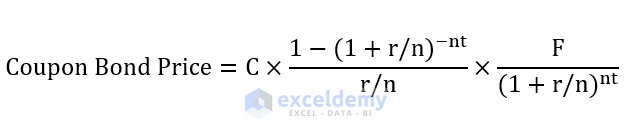

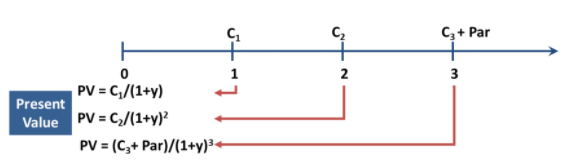

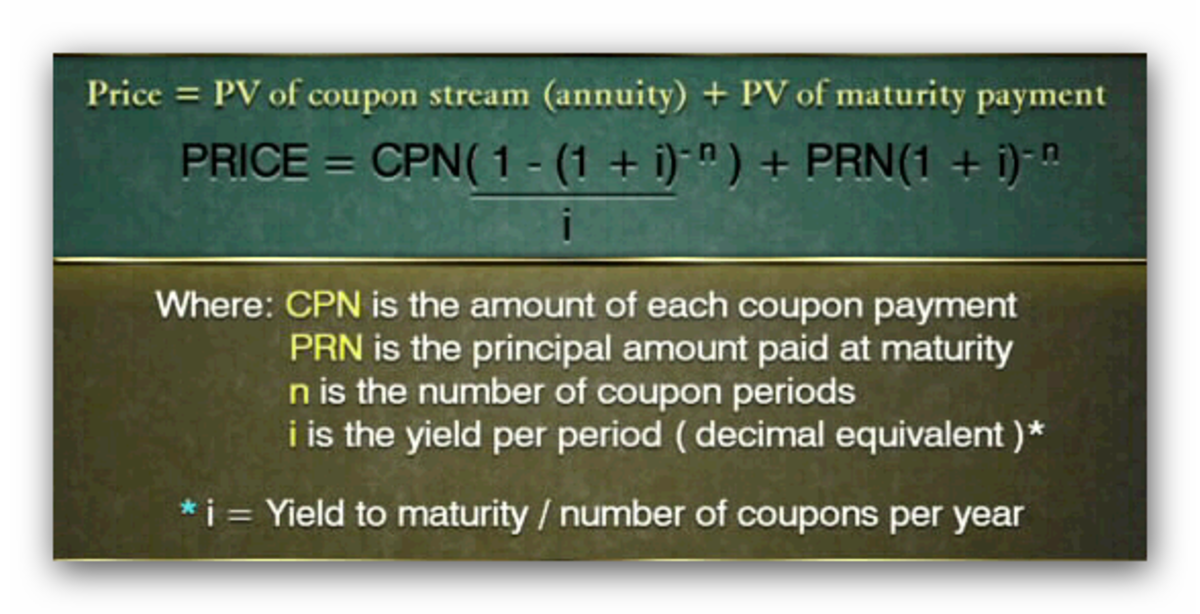

Bond Yield Formula | Calculator (Example with Excel Template) The formula for Bond Yield can be calculated by using the following steps: Step 1: Firstly, determine the bond’s par value be received at maturity and then determine coupon payments to be received periodically. Both par value and periodic coupon payments constitute the potential future cash flows. Present value - Wikipedia A bondholder will receive coupon payments semiannually (unless otherwise specified) in the amount of , until the bond matures, at which point the bondholder will receive the final coupon payment and the face value of a bond, (+). The present value of a bond is the purchase price.

Net Present Value Formula | Examples With Excel Template - EDUCBA NPV = Net Present Value Formula – Example #2. General Electric has the opportunity to invest in 2 projects. Project A requires an investment of $1 mn which will give a return of $300000 each year for 5 years.

Present value formula coupon bond

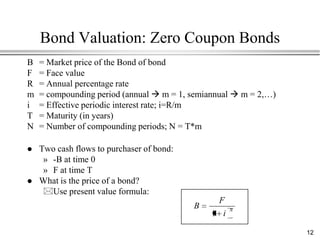

Present Value Factor Formula | Calculator (Excel template) As present value of Rs. 5500 after two years is lower than Rs. 5000, it is better for Company Z to take Rs. 5000 today. Explanation of PV Factor Formula. Present value means today’s value of the cash flow to be received at a future point of time and present value factor formula is a tool/formula to calculate a present value of future cash flow. How to Calculate Bond Value: 6 Steps (with Pictures) - wikiHow Apr 19, 2021 · If you use a table, you will locate the present value factor for a 4% discount rate for 5 years. That factor is .822. The present value of $100 is ($100 X .822 = $82.20). The present value of your bond is (present value of all interest payments) + (present value of principal repayment at maturity). Bond Present Value Calculator Bond Present Value Calculator. Use the Bond Present Value Calculator to compute the present value of a bond. Input Form. Face Value is the value of the bond at maturity. Annual Coupon Rate is the yield of the bond as of its issue date. Annual Market Rate is the current market rate. It is also referred to as discount rate or yield to maturity.

Present value formula coupon bond. Present Value Formula | Calculator (Examples with Excel Template) Present Value= $961.54 + $924.56 + $889.00 + $854.80; Present Value = Therefore, the present-day value of John’s lottery winning is . Explanation. The formula for the present value can be derived by using the following steps: Step 1: Firstly, figure out the future cash flow which is denoted by CF. Step 2: Next, decide the discounting rate ... Bond Present Value Calculator Bond Present Value Calculator. Use the Bond Present Value Calculator to compute the present value of a bond. Input Form. Face Value is the value of the bond at maturity. Annual Coupon Rate is the yield of the bond as of its issue date. Annual Market Rate is the current market rate. It is also referred to as discount rate or yield to maturity. How to Calculate Bond Value: 6 Steps (with Pictures) - wikiHow Apr 19, 2021 · If you use a table, you will locate the present value factor for a 4% discount rate for 5 years. That factor is .822. The present value of $100 is ($100 X .822 = $82.20). The present value of your bond is (present value of all interest payments) + (present value of principal repayment at maturity). Present Value Factor Formula | Calculator (Excel template) As present value of Rs. 5500 after two years is lower than Rs. 5000, it is better for Company Z to take Rs. 5000 today. Explanation of PV Factor Formula. Present value means today’s value of the cash flow to be received at a future point of time and present value factor formula is a tool/formula to calculate a present value of future cash flow.

/dotdash_Final_Yield_to_Worst_YTW_Oct_2020-01-cabc0d0cf5b64ef0b4f72afb4888b3aa.jpg)

Post a Comment for "40 present value formula coupon bond"