43 coupon value of a bond

Coupon Bond - Guide, Examples, How Coupon Bonds Work Oct 13, 2022 · Upon the issuance of the bond, a coupon rate on the bond’s face value is specified. The issuer of the bond agrees to make annual or semi-annual interest payments equal to the coupon rate to investors. These payments are made until the bond’s maturity. Let’s imagine that Apple Inc. issued a new four-year bond with a face value of $100 and an annual coupon rate of 5% of the bond’s face value. What Is the Coupon Rate of a Bond? - The Balance Nov 18, 2021 · A coupon rate is the annual amount of interest paid by the bond stated in dollars, divided by the par or face value. For example, a bond that pays $30 in annual interest with a par value of $1,000 would have a coupon rate of 3%. Note

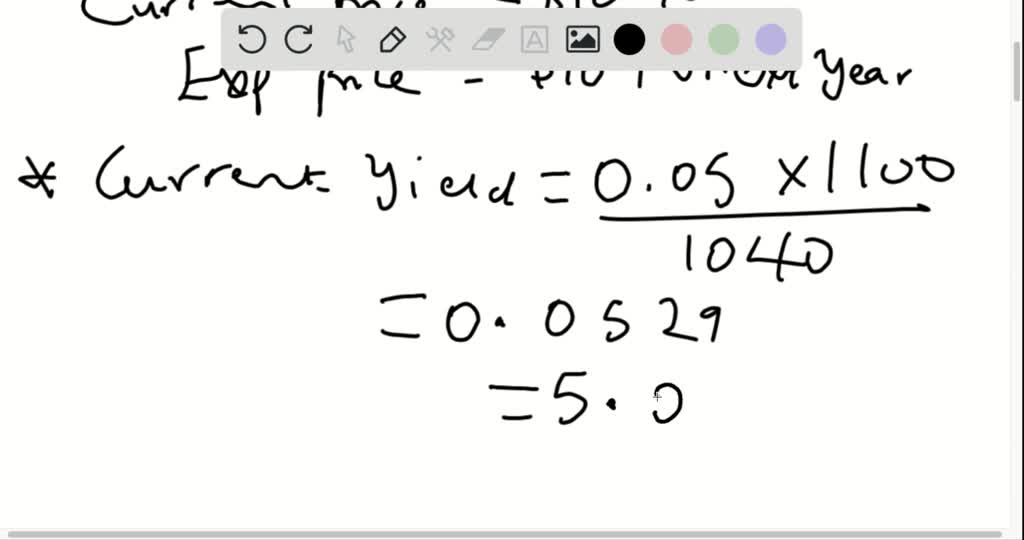

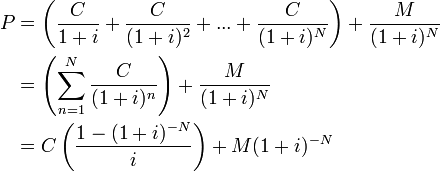

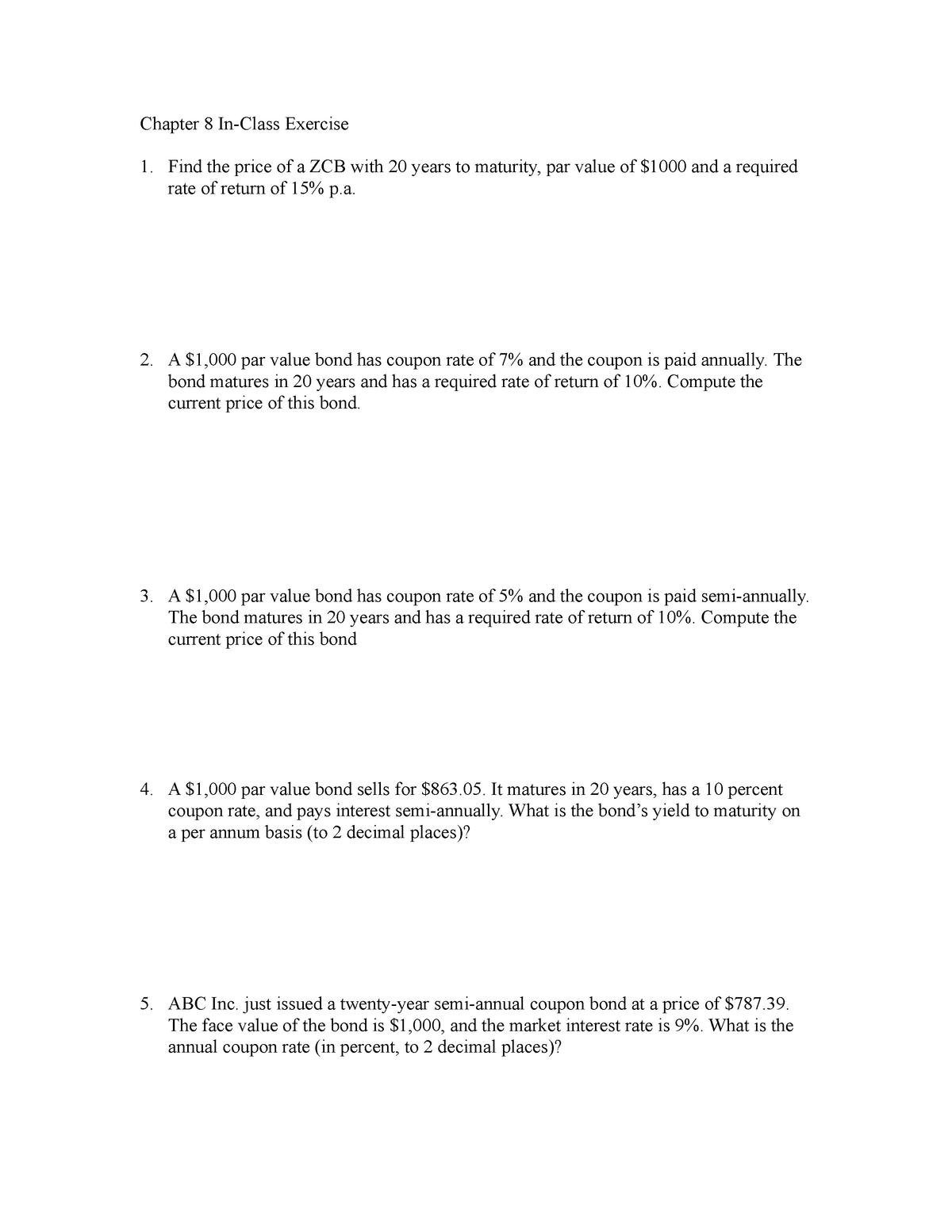

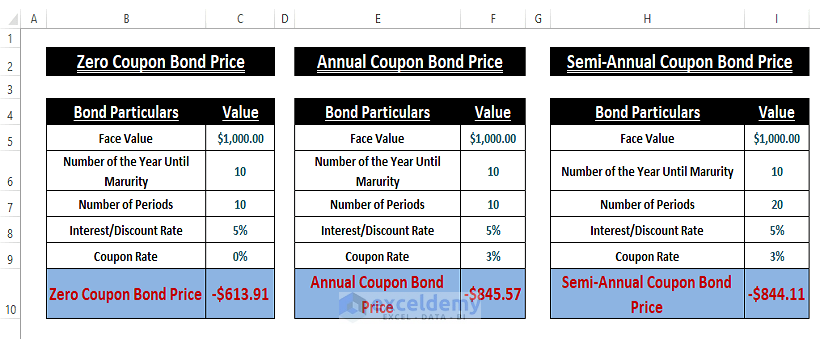

How to Calculate the Price of Coupon Bond? - WallStreetMojo Mathematically, it the price of a coupon bond is represented as follows, Coupon Bond = ∑i=1n [C/ (1+YTM)i + P/ (1+YTM)n] Coupon Bond = C * [1- (1+YTM)-n/YTM + P/ (1+YTM)n] You are free to use this image on your website, templates, etc, Please provide us with an attribution link. where.

Coupon value of a bond

Coupon Rate of a Bond (Formula, Definition) | Calculate ... As per the given question, Par value of bond = $1,000. Annual interest payment = 4 * Quarterly interest payment. = 4 * $15. = $60. Therefore, the coupon rate of the bond can be calculated using the above formula as, Since the coupon (6%) is lower than the market interest (7%), the bond will be traded at a discount. Coupon Bond - Investopedia A coupon bond, also referred to as a bearer bond or bond coupon, is a debt obligation with coupons attached that represent semiannual interest payments. With coupon bonds, there are no records of the purchaser kept by the issuer; the purchaser's name is also not printed on any kind of certificate. Bondholders receive these coupons during the period between the issuance of the bond and the maturity of the bond.

Coupon value of a bond. Coupon Bond - Investopedia A coupon bond, also referred to as a bearer bond or bond coupon, is a debt obligation with coupons attached that represent semiannual interest payments. With coupon bonds, there are no records of the purchaser kept by the issuer; the purchaser's name is also not printed on any kind of certificate. Bondholders receive these coupons during the period between the issuance of the bond and the maturity of the bond. Coupon Rate of a Bond (Formula, Definition) | Calculate ... As per the given question, Par value of bond = $1,000. Annual interest payment = 4 * Quarterly interest payment. = 4 * $15. = $60. Therefore, the coupon rate of the bond can be calculated using the above formula as, Since the coupon (6%) is lower than the market interest (7%), the bond will be traded at a discount.

Post a Comment for "43 coupon value of a bond"