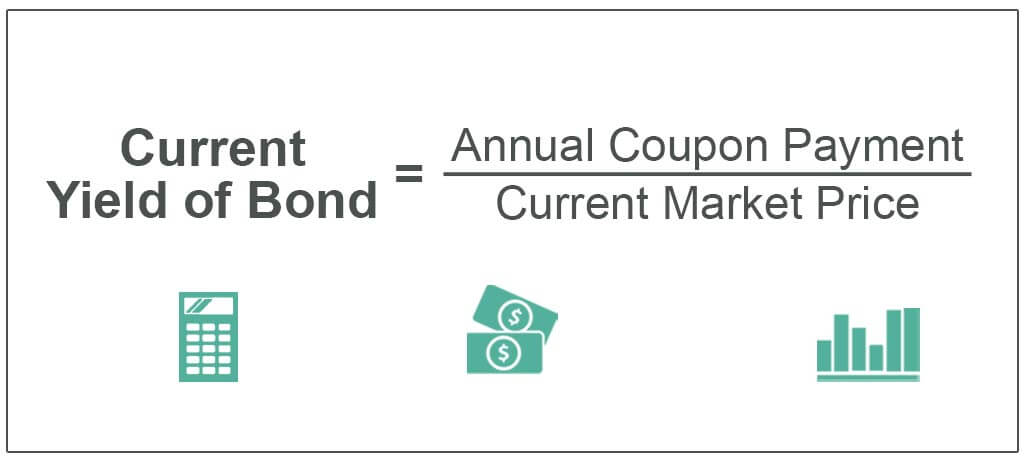

39 the coupon rate of a bond is equal to

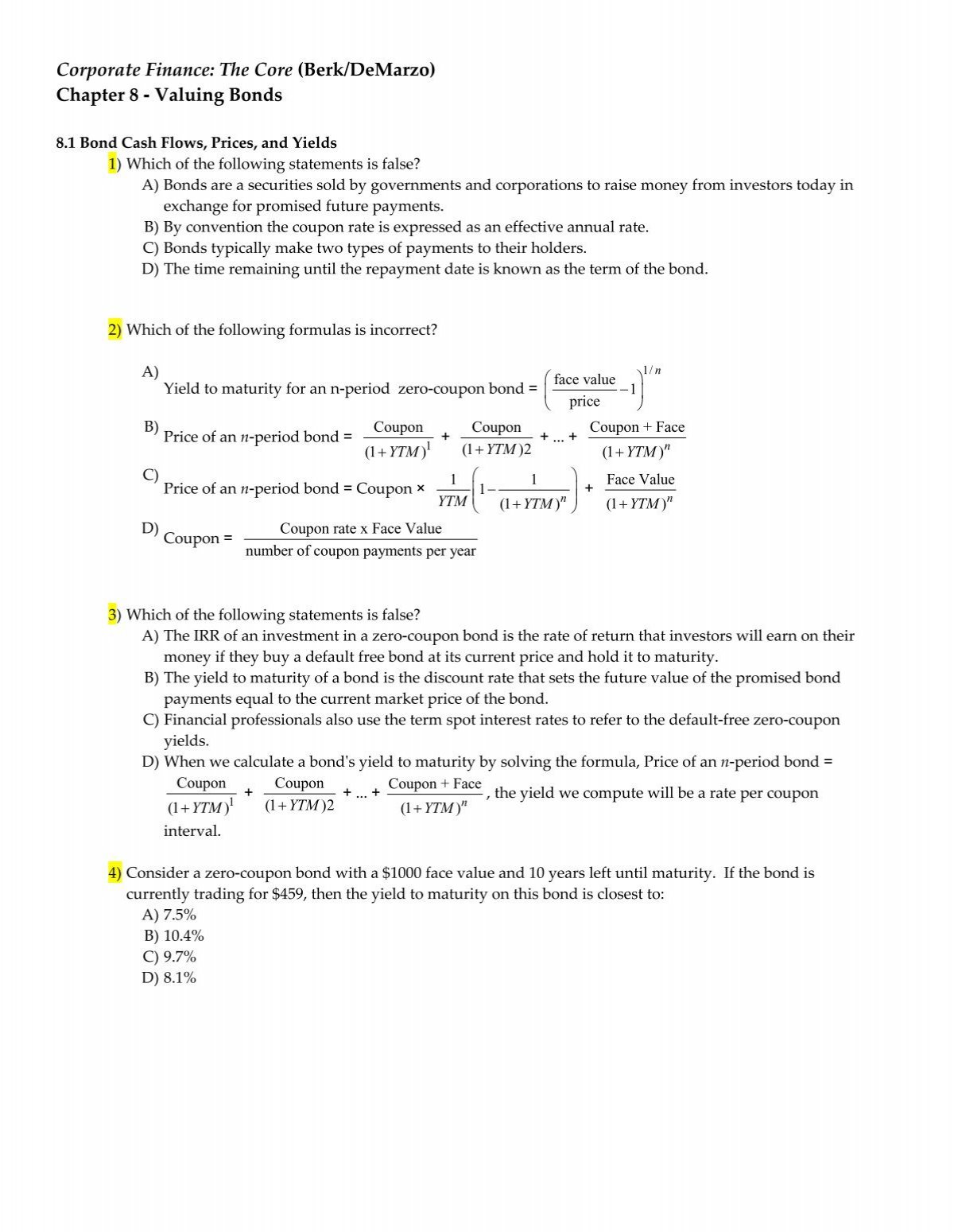

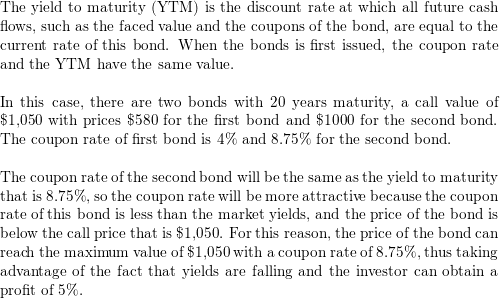

How would you prove that, when a bond's yield to maturity is equal ... Sep 1, 2021 ... The price of the bond is different from the face value ONLY if the yield of the bond is either above or below the coupon rate. If it is exactly the same as ... Zero-coupon bond - Wikipedia A strip bond has no reinvestment risk because the payment to the investor occurs only at maturity. The impact of interest rate fluctuations on strip bonds, known as the bond duration, is higher than for a coupon bond. A zero coupon bond always has a duration equal to its maturity, and a coupon bond always has a lower duration.

What Is Coupon Rate and How Do You Calculate It? - SmartAsset.com Aug 26, 2022 ... Here's a closer look at bond coupon rate. The coupon rate is calculated by adding up the total amount of annual payments made by a bond, then ...

The coupon rate of a bond is equal to

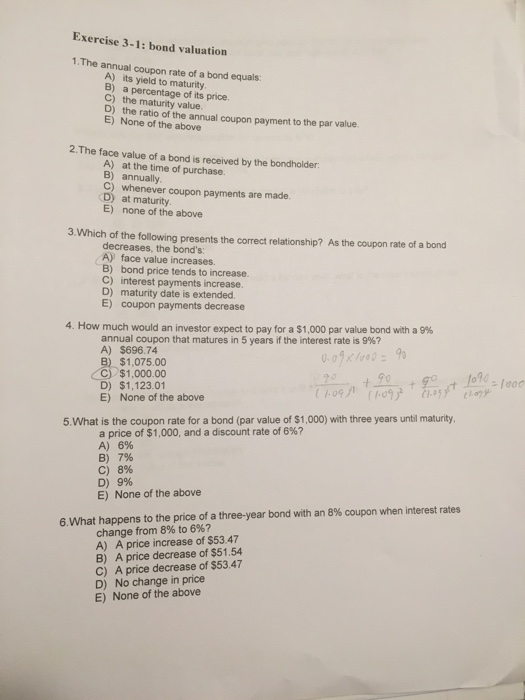

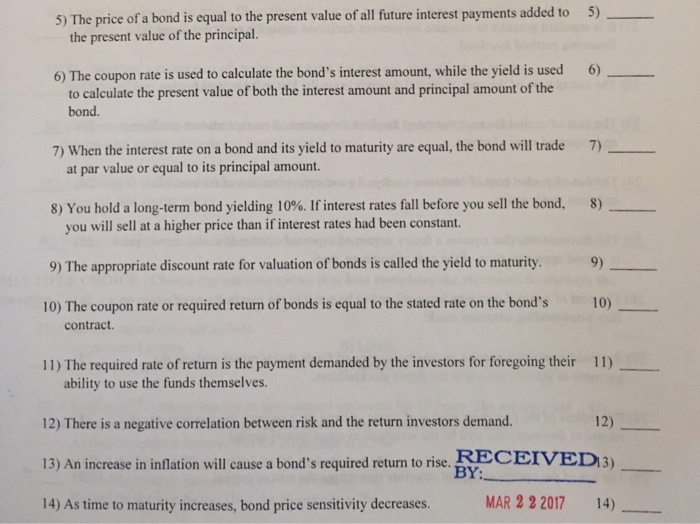

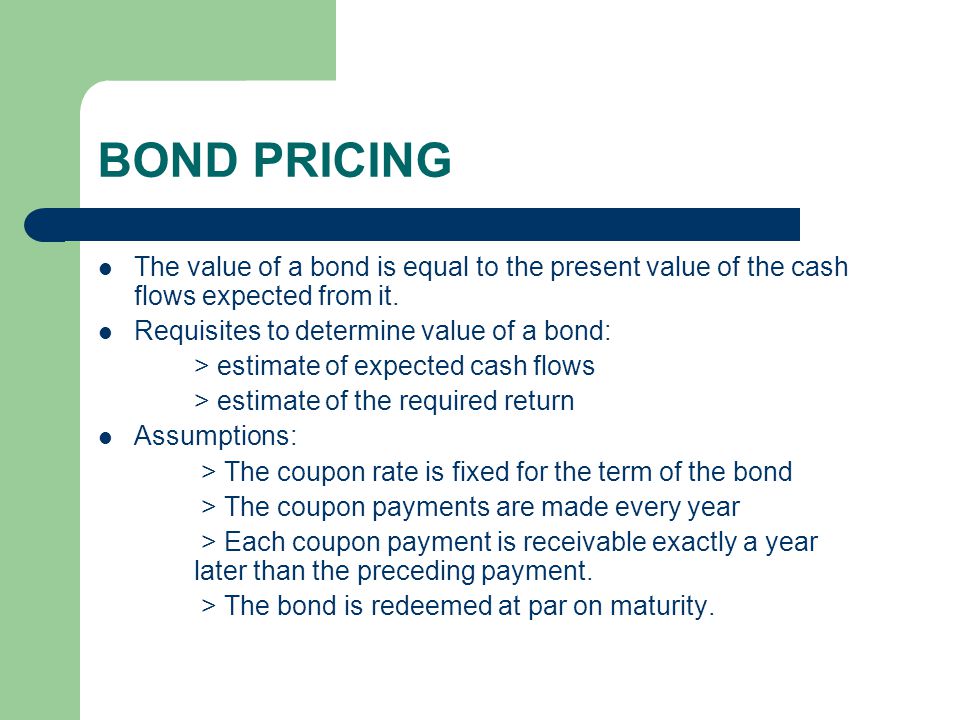

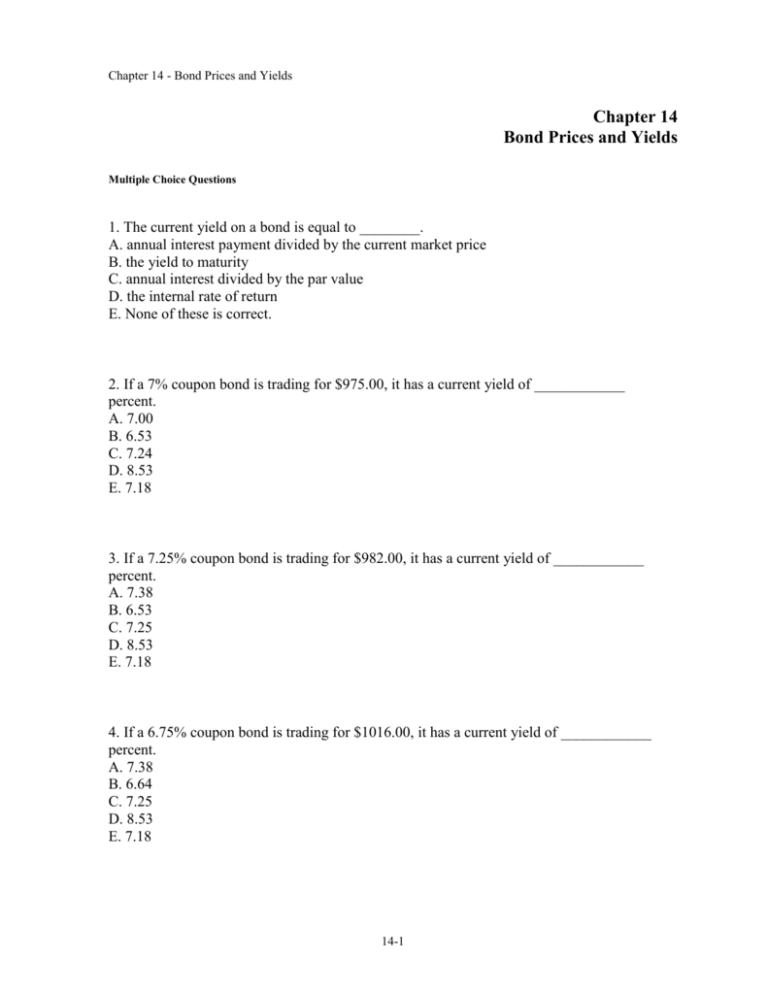

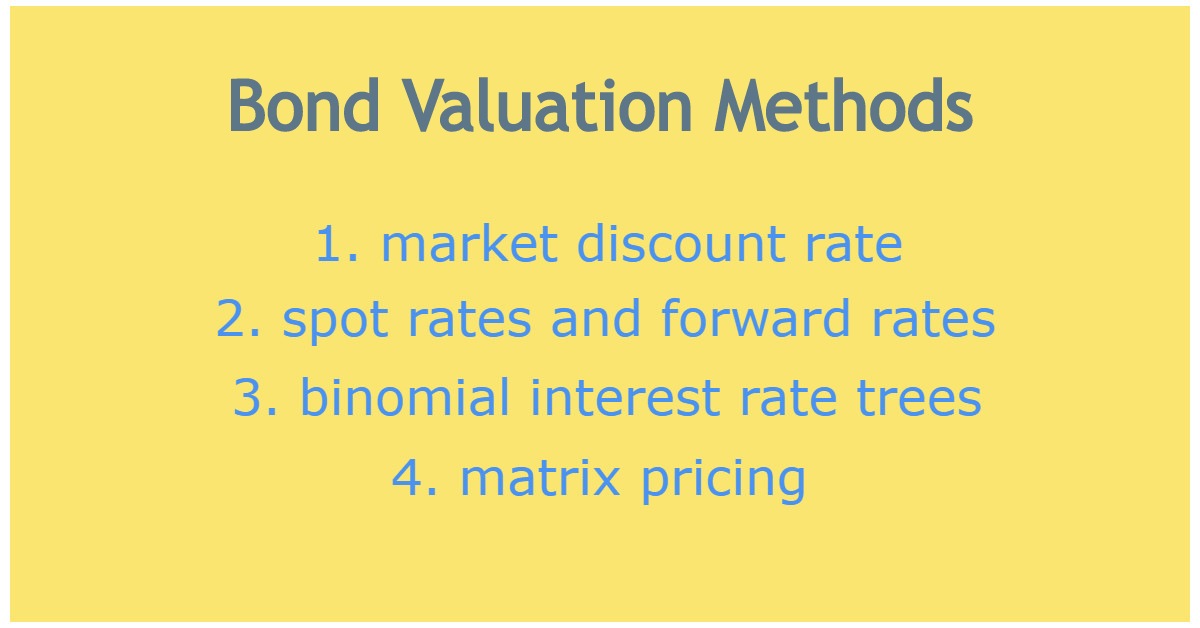

Coupon Rate of a Bond (Formula, Definition) - WallStreetMojo Finally, the formula of the coupon rate of the bond is calculated by dividing the annualized interest payments by the par value of the bond and multiplied by ... Finance Ch. 6 - Multiple Choice Flashcards - Quizlet Study with Quizlet and memorize flashcards containing terms like 23. The coupon rate of a bond equals: A. its yield to maturity. B. a percentage of its face ... What Is the Coupon Rate of a Bond? - The Balance Nov 18, 2021 ... A bond's coupon rate is the fixed dollar value of the annual interest the bondholder will receive. It is stated as a percentage of the ...

The coupon rate of a bond is equal to. Coupon Rate - Definition - The Economic Times The bond issuer pays the interest annually until maturity, and after that returns the principal amount (or face value) also. Coupon rate is not the same as the ... The coupon rate of a bond equals ______. a. its yield to maturity b. a ... The coupon rate is the defined percentage of the bond's face value. where coupon amount equals (Face value of the bonds × Coupon rate). c. the yield to maturity ... Bond (finance) - Wikipedia The coupon is the interest rate that the issuer pays to the holder. For fixed rate bonds, the coupon is fixed throughout the life of the bond. For floating rate notes, the coupon varies throughout the life of the bond and is based on the movement of a money market reference rate (often LIBOR). Coupon Rate Formula | Calculator (Excel Template) - EDUCBA Coupon Rate = (20 / 100) * 100; Coupon Rate = 20% Now, if the market rate of interest is lower than 20% than the bond will be traded at a premium as this bond gives more value to the investors compared to other fixed income securities.

Bond Yield Rate vs. Coupon Rate: What's the Difference? Mar 22, 2022 · Coupon Pass: The purchase of treasury notes or bonds from dealers, by the Federal Reserve. Coupon Rate Definition - Investopedia May 28, 2022 · Coupon Rate: A coupon rate is the yield paid by a fixed-income security; a fixed-income security's coupon rate is simply just the annual coupon payments paid by the issuer relative to the bond's ... Interest Rate Statistics | U.S. Department of the Treasury To estimate a 30-year rate during that time frame, this series includes the Treasury 20-year Constant Maturity rate and an "adjustment factor," which may be added to the 20-year rate to estimate a 30-year rate during the period of time in which Treasury did not issue the 30-year bonds. Detailed information is provided with the data When is a bond's coupon rate and yield to maturity the same? A bond's coupon rate is equal to its yield to maturity if its purchase price is equal to its par value. The par value of a bond is its face value, ...

Learn How Coupon Rate Affects Bond Pricing Oct 11, 2022 ... All types of bonds pay interest to the bondholder. The amount of interest is known as the coupon rate. Unlike other financial products, the ... Yield to Maturity vs. Coupon Rate: What's the Difference? May 20, 2022 · If an investor purchases a bond at par or face value, the yield to maturity is equal to its coupon rate. If the investor purchases the bond at a discount, its yield to maturity will be higher than ... What Is the Coupon Rate of a Bond? - The Balance Nov 18, 2021 ... A bond's coupon rate is the fixed dollar value of the annual interest the bondholder will receive. It is stated as a percentage of the ... Finance Ch. 6 - Multiple Choice Flashcards - Quizlet Study with Quizlet and memorize flashcards containing terms like 23. The coupon rate of a bond equals: A. its yield to maturity. B. a percentage of its face ...

Coupon Rate of a Bond (Formula, Definition) - WallStreetMojo Finally, the formula of the coupon rate of the bond is calculated by dividing the annualized interest payments by the par value of the bond and multiplied by ...

:max_bytes(150000):strip_icc()/manlookingatcomputer-2368f094bfc7428b8e7b86e34186139d.jpeg)

Post a Comment for "39 the coupon rate of a bond is equal to"