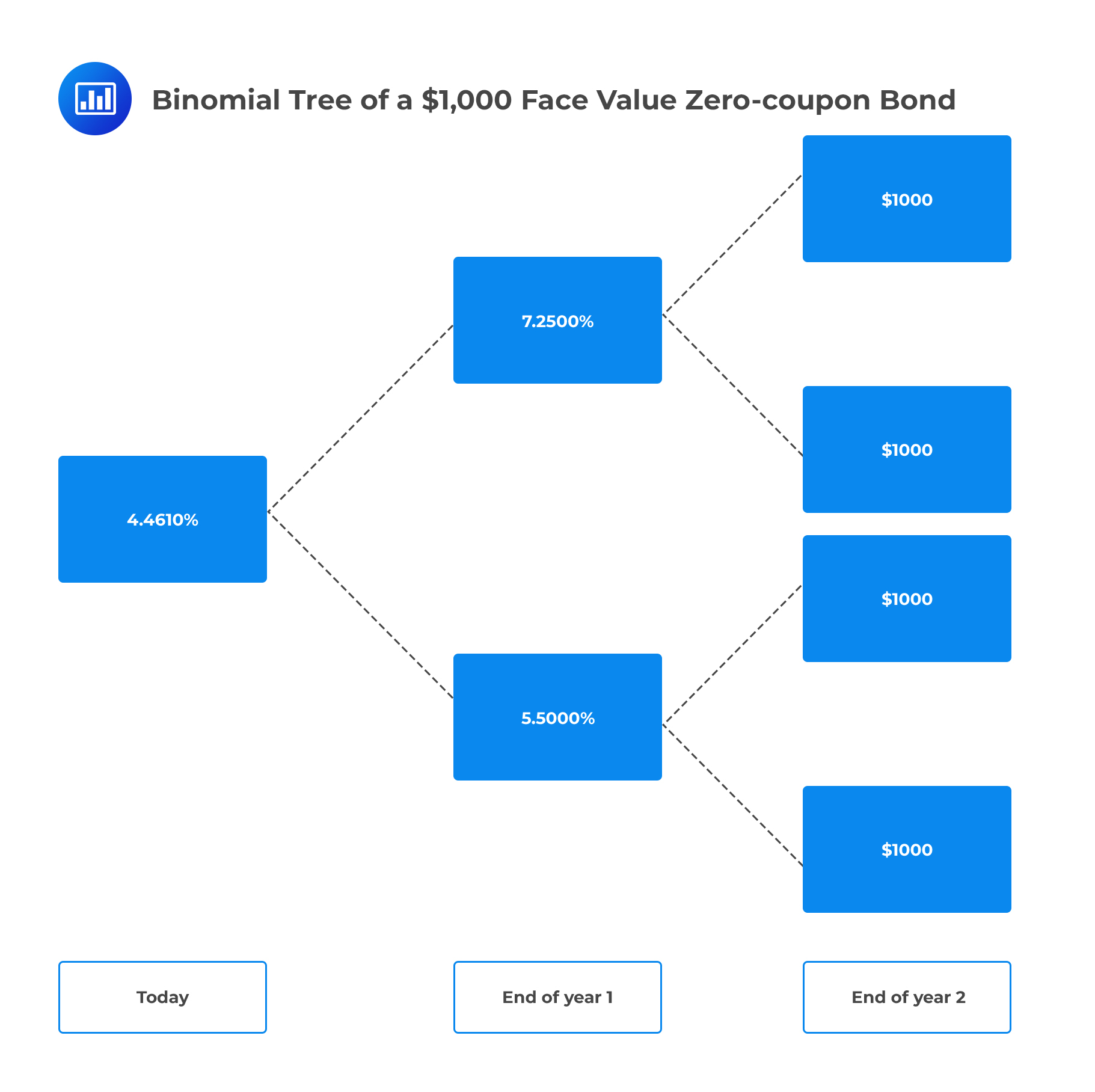

38 valuing zero coupon bonds

WRAL | Breaking News in Raleigh NC, Weather, and Traffic WebWRAL - NBC News Channel 5 - Raleigh breaking news, North Carolina news today, WRAL weather forecasts, NC lottery updates. WRAL news in Raleigh, NC Join LiveJournal WebPassword requirements: 6 to 30 characters long; ASCII characters only (characters found on a standard US keyboard); must contain at least 4 different symbols;

Black model - Wikipedia WebThe Black model (sometimes known as the Black-76 model) is a variant of the Black–Scholes option pricing model. Its primary applications are for pricing options on future contracts, bond options, interest rate cap and floors, and swaptions.It was first presented in a paper written by Fischer Black in 1976.. Black's model can be generalized into a class …

Valuing zero coupon bonds

Smart Slider — The new way to build a WordPress slider 🎓 WebJoin over 800,000 users and find out why Smart Slider became the best WordPress slider plugin. Build better sliders for free! Could Call of Duty doom the Activision Blizzard deal? - Protocol WebOct 14, 2022 · Hello, and welcome to Protocol Entertainment, your guide to the business of the gaming and media industries. This Friday, we’re taking a look at Microsoft and Sony’s increasingly bitter feud over Call of Duty and whether U.K. regulators are leaning toward torpedoing the Activision Blizzard deal. Replicating portfolio - Wikipedia WebFor example, suppose your cash flows over a 7-year period are, respectively, $2, $2, $2, $50, $2, $2, $102. You could buy a $100 seven-year bond with a 2% dividend, and a four-year zero-coupon bond with a maturity value of 48. The market price of those two instruments (that is, the cost of buying this simple replicating portfolio) might be $145 ...

Valuing zero coupon bonds. Perpetual Bond: Definition, Example, Formula To Calculate Value WebMar 19, 2020 · Perpetual Bond: A perpetual bond is a fixed income security with no maturity date . One major drawback to these types of bonds is that they are not redeemable. Given this drawback, the major ... Sasol to offer R14bn in dollar bonds - Moneyweb WebNov 02, 2022 · Sasol estimated, in its initial announcement on Tuesday, that the bonds are expected to pay a coupon of between 4% and 4.5% per annum. It announced later in the day that the pricing was eventually ... Overwatch 2 reaches 25 million players, tripling Overwatch 1 daily ... WebOct 14, 2022 · Following a bumpy launch week that saw frequent server trouble and bloated player queues, Blizzard has announced that over 25 million Overwatch 2 players have logged on in its first 10 days."Sinc Finance - Wikipedia WebFinance is the study and discipline of money, currency and capital assets.It is related to, but not synonymous with economics, the study of production, distribution, and consumption of money, assets, goods and services (the discipline of financial economics bridges the two). Finance activities take place in financial systems at various scopes, thus the field can be …

Replicating portfolio - Wikipedia WebFor example, suppose your cash flows over a 7-year period are, respectively, $2, $2, $2, $50, $2, $2, $102. You could buy a $100 seven-year bond with a 2% dividend, and a four-year zero-coupon bond with a maturity value of 48. The market price of those two instruments (that is, the cost of buying this simple replicating portfolio) might be $145 ... Could Call of Duty doom the Activision Blizzard deal? - Protocol WebOct 14, 2022 · Hello, and welcome to Protocol Entertainment, your guide to the business of the gaming and media industries. This Friday, we’re taking a look at Microsoft and Sony’s increasingly bitter feud over Call of Duty and whether U.K. regulators are leaning toward torpedoing the Activision Blizzard deal. Smart Slider — The new way to build a WordPress slider 🎓 WebJoin over 800,000 users and find out why Smart Slider became the best WordPress slider plugin. Build better sliders for free!

Post a Comment for "38 valuing zero coupon bonds"