40 coupon paying bond formula

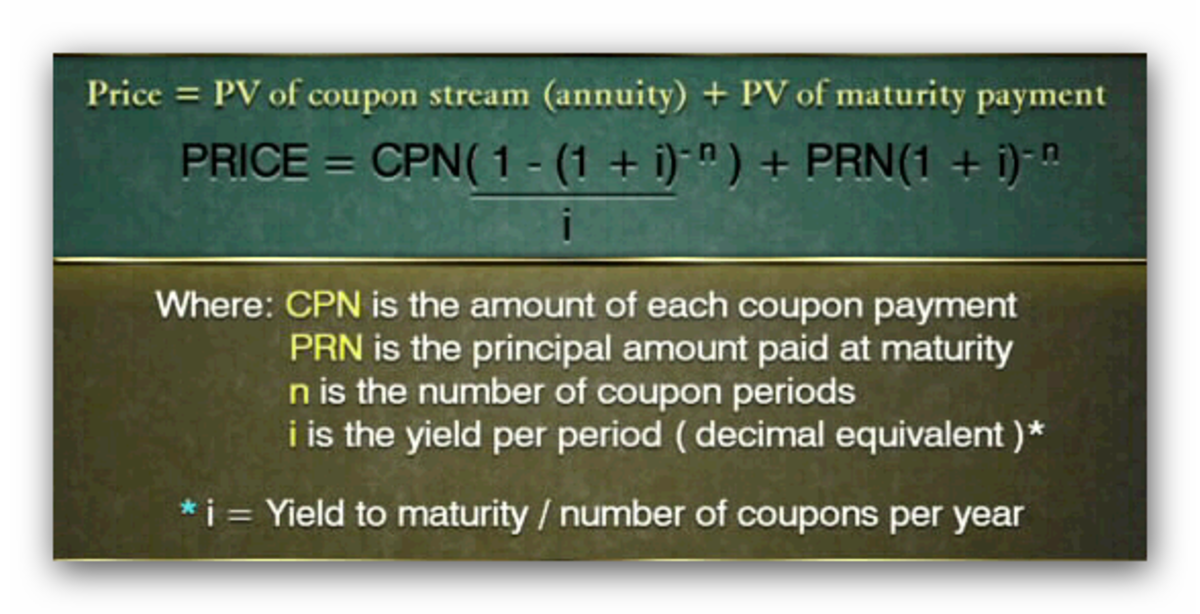

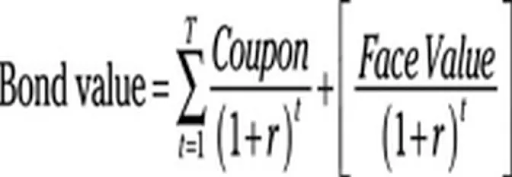

Paddy Power™ Online Sports Betting Site » Bet on Sports Bet online with Paddy Power™ and browse the latest sports betting odds Online Bets Latest Betting Odds Sports Betting UK Bet Builder 18+ Gamble Responsibly Bond Pricing Formula |How to Calculate Bond Price? - EDUCBA Bond pricing is the formula used to calculate the prices of the bond being sold in the primary or secondary market. Bond Price = ∑ (Cn / (1+YTM)n )+ P / (1+i)n. Where. n = Period which takes values from 0 to the nth period till the cash flows ending period. Cn = Coupon payment in the nth period. YTM = interest rate or required yield.

Zero Coupon Bond Value Calculator: Calculate Price, Yield to … Example Zero-coupon Bond Formula. P = M / (1+r) n. variable definitions: P = price; M = maturity value; r = annual yield divided by 2; ... Investment bankers & bond dealers have the ability to separate the components of a traditional coupon-paying bond into the coupon & the principal (or residue). The coupon payments & residue can be sold ...

Coupon paying bond formula

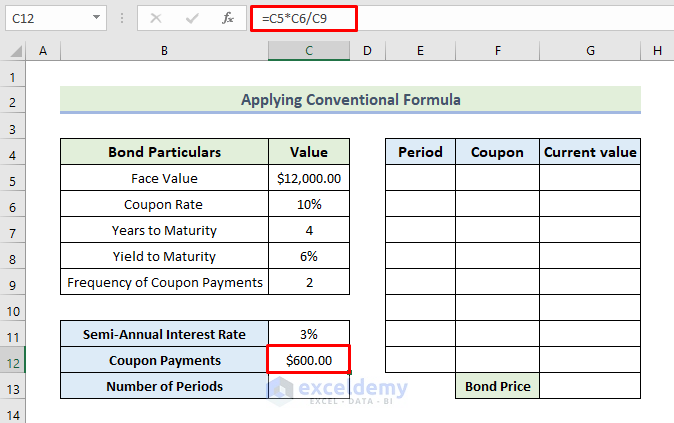

Coupon Rate Formula | Calculator (Excel Template) - EDUCBA Coupon Rate is calculated using the formula given below Coupon Rate = (Annual Coupon (or Interest) Payment / Face Value of Bond) * 100 Coupon Rate = (86.7 / 1000) * 100 Coupon Rate= 8.67% Coupon Rate Formula - Example #3 Tata Capital Financial Services Ltd. Issued secured and unsecured NCDs in Sept 2018. Details of the issue are as following: Coupon Bond Formula | How to Calculate the Price of Coupon Bond? Mathematically, it the price of a coupon bond is represented as follows, Coupon Bond = ∑i=1n [C/ (1+YTM)i + P/ (1+YTM)n] Coupon Bond = C * [1- (1+YTM)-n/YTM + P/ (1+YTM)n] You are free to use this image on your website, templates, etc, Please provide us with an attribution link where C = Periodic coupon payment, P = Par value of bond, Coupon Rate Calculator | Bond Coupon annual coupon payment = coupon payment per period * coupon frequency As this is a semi-annual coupon bond, our annual coupon rate calculator uses coupon frequency of 2. And the annual coupon payment for Bond A is: $25 * 2 = $50. Calculate the coupon rate The last step is to calculate the coupon rate.

Coupon paying bond formula. How to Calculate Yield to Maturity of a Zero-Coupon Bond - Investopedia Oct 10, 2022 · Zero-Coupon Bond Formula . The formula for calculating the yield to maturity on a zero-coupon bond is: ... Corporate zero-coupon bonds are usually riskier than similar coupon-paying bonds. › government › organisationsHM Treasury - GOV.UK HM Treasury is the government’s economic and finance ministry, maintaining control over public spending, setting the direction of the UK’s economic policy and working to achieve strong and ... Bond Valuation: Calculation, Definition, Formula, and Example May 31, 2022 · Bond valuation is a technique for determining the theoretical fair value of a particular bond. Bond valuation includes calculating the present value of the bond's future interest payments, also ... Bond Yield Formula | Step by Step Calculation & Examples - WallStreetMojo Bond Yield Formula = Annual Coupon Payment / Bond Price Bond Prices and Bond Yield have an inverse relationship When bond price increases, bond yield decreases. When bond price decreases, bond yield increases. You are free to use this image on your website, templates, etc, Please provide us with an attribution link

Bond Yield Formula | Calculator (Example with Excel Template) - EDUCBA Bond Price = ∑ [Cash flowt / (1+YTM)t] The formula for a bond's current yield can be derived by using the following steps: Step 1: Firstly, determine the potential coupon payment to be generated in the next one year. Step 2: Next, figure out the current market price of the bond. Step 3: Finally, the formula for current yield can be derived ... › terms › zZero-Coupon Bond: Definition, How It Works ... - Investopedia May 31, 2022 · Zero-Coupon Bond: A zero-coupon bond is a debt security that doesn't pay interest (a coupon) but is traded at a deep discount, rendering profit at maturity when the bond is redeemed for its full ... Coupon Payment Bond Formula - uslegalforms.com Coupon Rate Formula — The formula to calculate a bond's coupon rate is very straightforward, as detailed below. Using the bond valuation formulas as just completed above, the value of bond B with a yield of. Show more Gold Award 2006-2018 BEST Legal Forms Company 11 Year Winner in all Categories: Forms, Features, Customer Service and Ease of Use. Zero-Coupon Bond: Definition, How It Works, and How To Calculate May 31, 2022 · Zero-Coupon Bond: A zero-coupon bond is a debt security that doesn't pay interest (a coupon) but is traded at a deep discount, rendering profit at maturity when the bond is redeemed for its full ...

HM Treasury - GOV.UK HM Treasury is the government’s economic and finance ministry, maintaining control over public spending, setting the direction of the UK’s economic policy and working to achieve strong and ... How Can I Calculate a Bond's Coupon Rate in Excel? - Investopedia In cell A3, enter the formula "=A1*A2" to yield the total annual coupon payment. Moving down the spreadsheet, enter the par value of your bond in cell B1. Most bonds have par values of $100 or ... › coupon-rate-bondCoupon Rate of a Bond (Formula, Definition) | Calculate ... Formula. The coupon rate of a bond can be calculated by dividing the sum of the annual coupon payments by the par value of the bond and multiplied by 100%. Therefore, the rate of a bond can also be seen as the amount of interest paid per year as a percentage of the face value or par value of the bond. Mathematically, it is represented as, Coupon Bond | Coupon Bond Price | Examples of Coupon Bond - EDUCBA The formula for CB is derived based on the sum of the present value of all the future cash inflows either in the form of coupons or principal at maturity. The yield to maturity is used to discount the future cash flows to present value. ... Let us take the example of another bond issuance by ZXC Inc., and these bonds pay coupons semi-annually ...

Coupon Rate of a Bond (Formula, Definition) - WallStreetMojo Formula. The coupon rate of a bond can be calculated by dividing the sum of the annual coupon payments by the par value of the bond and multiplied by 100%. Therefore, the rate of a bond can also be seen as the amount of interest paid per year as a percentage of the face value or par value of the bond. Mathematically, it is represented as,

Zero Coupon Bond Calculator – What is the Market Price? - DQYDJ The zero coupon bond price formula is: \frac{P}{(1+r)^t} where: P: The par or face value of the zero coupon bond; r: The interest rate of the bond; ... So a 10 year zero coupon bond paying 10% interest with a $1000 face value would cost you $385.54 today. In the opposite direction, ...

Bond Formula | How to Calculate a Bond | Examples with Excel Template Mathematically, the formula for coupon bond is represented as, Coupon Bond Price = C * [ (1- (1 + r / n )-n*t ) / (r/n) ] + [F / (1 + r / n) n*t] where, C = Annual Coupon Payment F = Par Value at Maturity r = YTM n = Number of Coupon Payments in A Year t = Number of Years until Maturity

What is the discount factor formula for a coupon paying bond? For example, a$1,000 face 4% semi-annual pay 10-year bond at a 2% discount rate is worth: $1,000* [2% / 1% + (1 - 2% / 1%)*1.02^-20] = $1,000* [2 - 1.02^-20] = $1,327.03 One important qualification is that the yield has to be stated at the same compounding interval as the bond payments. In the example, y must be a semi-annual yield.

Google Search the world's information, including webpages, images, videos and more. Google has many special features to help you find exactly what you're looking for.

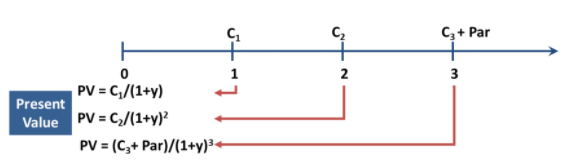

Calculate the Value of a Coupon Paying Bond - Finance Train Par Value = $1,000. Yield = 13% annual (13/2 =6.5% semi-annual) Coupon = 12% with semi-annual payment of $60. Maturity = 1 year. The value of the bond is calculated as follows: Note that the coupon is paid semi-annually, i.e., $60 per 6 months. The discounting is also done semi-annually. The general bond pricing formula for all bonds can be ...

Bond Pricing - Formula, How to Calculate a Bond's Price Zero-coupon bonds are typically priced lower than bonds with coupons. Bond Pricing: Principal/Par Value. Each bond must come with a par value that is repaid at maturity. Without the principal value, a bond would have no use. The principal value is to be repaid to the lender (the bond purchaser) by the borrower (the bond issuer). A zero-coupon ...

Coupon Rate Formula | Step by Step Calculation (with Examples) The formula for coupon rate is computed by dividing the sum of the coupon payments paid annually by the bond's par value and then expressed in percentage. Coupon Rate = Total Annual Coupon Payment / Par Value of Bond * 100% You are free to use this image on your website, templates, etc, Please provide us with an attribution link

Amortizing loan - Wikipedia In banking and finance, an amortizing loan is a loan where the principal of the loan is paid down over the life of the loan (that is, amortized) according to an amortization schedule, typically through equal payments.. Similarly, an amortizing bond is a bond that repays part of the principal along with the coupon payments. Compare with a sinking fund, which amortizes the total debt …

dqydj.com › zero-coupon-bond-calculatorZero Coupon Bond Calculator – What is the Market Price ... The zero coupon bond price formula is: \frac{P}{(1+r)^t} ... So a 10 year zero coupon bond paying 10% interest with a $1000 face value would cost you $385.54 today.

Zero-Coupon Bond - Definition, How It Works, Formula Price of bond = $1,000 / (1+0.05) 5 = $783.53 The price that John will pay for the bond today is $783.53. Example 2: Semi-annual Compounding John is looking to purchase a zero-coupon bond with a face value of $1,000 and 5 years to maturity. The interest rate on the bond is 5% compounded semi-annually. What price will John pay for the bond today?

Bond Pricing Formula | How to Calculate Bond Price? | Examples The formula for bond pricing is the calculation of the present value of the probable future cash flows, which comprises the coupon payments and the par value, which is the redemption amount on maturity. The rate of interest used to discount the future cash flows is known as the yield to maturity (YTM.) Bond Price = ∑i=1n C/ (1+r)n + F/ (1+r)n or

Coupon Bond - Guide, Examples, How Coupon Bonds Work A coupon bond is a type of bond that includes attached coupons and pays periodic (typically annual or semi-annual) interest payments during its lifetime and its par value at maturity. These bonds come with a coupon rate, which refers to the bond's yield at the date of issuance. Bonds that have higher coupon rates offer investors higher yields ...

calculator.me › savings › zero-coupon-bondsZero Coupon Bond Value Calculator: Calculate Price, Yield to ... Example Zero-coupon Bond Formula. P = M / (1+r) n. variable definitions: P = price; M = maturity value; r = annual yield divided by 2; n = years until maturity times 2; The above formula is the one we use in our calculator to calculate the discount to face value every half-year throughout the duration of the bond's term.

Coupon Bond Formula | Examples with Excel Template - EDUCBA Coupon Bond is calculated using the Formula given below Coupon Bond = C * [1 - (1+Y/n)-n*t/ Y ] + [ F/ (1+Y/n)n*t] Coupon Bond = $25 * [1 - (1 + 4.5%/2) -16] + [$1000 / (1 + 4.5%/2) 16 Coupon Bond = $1,033

› ask › answersHow to Calculate Yield to Maturity of a Zero-Coupon Bond Oct 10, 2022 · Zero-Coupon Bond Formula . The formula for calculating the yield to maturity on a zero-coupon bond is: ... Corporate zero-coupon bonds are usually riskier than similar coupon-paying bonds.

Coupon Payment | Definition, Formula, Calculator & Example The coupon payment on each of these bonds is $32.5 [=$1,000 × 6.5% ÷ 2]. This means that Walmart Stores Inc. pays $32.5 after each six months to bondholders. Please note that coupon payments are calculated based on the stated interest rate (also called nominal yield) rather than the yield to maturity or the current yield.

en.wikipedia.org › wiki › Amortizing_loanAmortizing loan - Wikipedia Similarly, an amortizing bond is a bond that repays part of the principal along with the coupon payments. Compare with a sinking fund, which amortizes the total debt outstanding by repurchasing some bonds. Each payment to the lender will consist of a portion of interest and a portion of principal.

Coupon Rate Calculator | Bond Coupon annual coupon payment = coupon payment per period * coupon frequency As this is a semi-annual coupon bond, our annual coupon rate calculator uses coupon frequency of 2. And the annual coupon payment for Bond A is: $25 * 2 = $50. Calculate the coupon rate The last step is to calculate the coupon rate.

Coupon Bond Formula | How to Calculate the Price of Coupon Bond? Mathematically, it the price of a coupon bond is represented as follows, Coupon Bond = ∑i=1n [C/ (1+YTM)i + P/ (1+YTM)n] Coupon Bond = C * [1- (1+YTM)-n/YTM + P/ (1+YTM)n] You are free to use this image on your website, templates, etc, Please provide us with an attribution link where C = Periodic coupon payment, P = Par value of bond,

Coupon Rate Formula | Calculator (Excel Template) - EDUCBA Coupon Rate is calculated using the formula given below Coupon Rate = (Annual Coupon (or Interest) Payment / Face Value of Bond) * 100 Coupon Rate = (86.7 / 1000) * 100 Coupon Rate= 8.67% Coupon Rate Formula - Example #3 Tata Capital Financial Services Ltd. Issued secured and unsecured NCDs in Sept 2018. Details of the issue are as following:

/dotdash_INV-final-How-Can-I-Calculate-a-Bonds-Coupon-Rate-in-Excel-June-2021-01-8ff43b6e77a4475fb98d82707a90fae0.jpg)

Post a Comment for "40 coupon paying bond formula"