41 find the coupon rate of a bond

Coupon Rate Definition - Investopedia A bond's coupon rate can be calculated by dividing the sum of the security's annual coupon payments and dividing them by the bond's par value. For example, a bond issued with a face value of $1,000... How to Calculate a Coupon Payment: 7 Steps (with Pictures) - wikiHow To calculate the payment based on the current yield, just multiply the current yield times the amount that you paid for the bond (note, that might not be the same as the bond's face value). For example, if you paid $800 for a bond and its current yield is 10%, your coupon payment is .1 * 800 or $80. [7] 3 Calculate the payment by frequency.

What is 'Coupon Rate' - The Economic Times Coupon rate is the rate of interest paid by bond issuers on the bond's face value. It is the periodic rate of interest paid by bond issuers to its purchasers. The coupon rate is calculated on the bond's face value (or par value), not on the issue price or market value. For example, if you have a 10-year- Rs 2,000 bond with a coupon rate of 10 ...

Find the coupon rate of a bond

Coupon Rate - Meaning, Calculation and Importance - Scripbox To calculate the couponrate for Company A's bond, we need to know the total annual interest payments. Total Annual Interest Payments = 50 + 50 = 100 Coupon Rate = 100 / 500 * 100 = 20% Therefore, the coupon rate for the Company A bond is 20%. Importance of Coupon Rate in Bonds Bonds pay interest to their holders. Coupon Bond - Guide, Examples, How Coupon Bonds Work A coupon bond is a type of bond that includes attached coupons and pays periodic (typically annual or semi-annual) interest payments during its lifetime and its par value at maturity. These bonds come with a coupon rate, which refers to the bond's yield at the date of issuance. Bonds that have higher coupon rates offer investors higher yields ... (Solved) - Calculate the coupon payment of the bond that has 1 years ... Boeing recently issued bonds ...

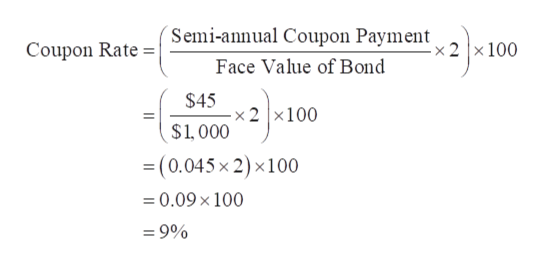

Find the coupon rate of a bond. Yield to Maturity vs. Coupon Rate: What's the Difference? May 20, 2022 · To calculate the bond's coupon rate, divide the total annual interest payments by the face value. In this case, the total annual interest payment equals $10 x 2 = $20. The annual coupon rate for ... Bond derivatives - Australian Securities Exchange Gain exposure to Australian debt markets by trading ASX Treasury Bond Futures and Options. Underpinned by a basket of liquid Australian Government Bonds, the 3, 5, 10 and 20 Year Treasury Bond Futures are a cost effective tool that can be used to enhance portfolio performance, manage duration, hedge risk exposures and take advantage of curve and spread trading … Bond Yield Rate vs. Coupon Rate: What's the Difference? How Do You Calculate Yield Rate? ... A bond's yield, or coupon rate, is computed by dividing its coupon payment by its face value. An updated yield rate can be ... Understanding Coupon Rate and Yield to Maturity of Bonds Here's a sample computation for a Retail Treasury Bond issued by the Bureau of Treasury: Security Name. Coupon Rate. Maturity Date. RTB 03-11. 2.375%. 3/9/2024. The Coupon Rate is the interest rate that the bond pays annually, gross of applicable taxes. The frequency of payment depends on the type of fixed income security.

Coupon Bond Formula | Examples with Excel Template - EDUCBA Calculate the market price of the bonds based on the given information. Solution: Coupon (C) is calculated using the Formula given below. C = Annual Coupon Rate * F C = 5% * $1000 C = $50 Coupon Bond is calculated using the Formula given below. Coupon Bond = C * [1 - (1+Y/n)-n*t/ Y ] + [ F/ (1+Y/n)n*t] How To Find Coupon Rate Of A Bond On Financial Calculator Once you have this information, you can follow these steps to calculate the coupon rate: 1) Enter the face value of the bond into the calculator. 2) Enter the coupon rate into the calculator. 3) Enter the number of years until the bond matures into the calculator. 4) Enter the market interest rate into the calculator. Coupon Rate - Learn How Coupon Rate Affects Bond Pricing The issuer makes periodic interest payments until maturity when the bondholder's initial investment - the face value (or "par value") of the bond - is returned to the bondholder. Formula for Calculating the Coupon Rate Where: C = Coupon rate i = Annualized interest P = Par value, or principal amount, of the bond Download the Free Template Zero Coupon Bond Value - Formula (with Calculator) After 5 years, the bond could then be redeemed for the $100 face value. Example of Zero Coupon Bond Formula with Rate Changes. A 6 year bond was originally issued one year ago with a face value of $100 and a rate of 6%. As the prior example shows, the value at the 6% rate with 5 years remaining would be $74.73.

Coupon Rate: Formula and Bond Nominal Yield Calculator The formula for the coupon rate consists of dividing the annual coupon payment by the par value of the bond. Coupon Rate = Annual Coupon / Par Value of Bond For example, if the coupon rate on a bond is 6% on a $100k bond, the coupon payment comes out to $6k per year. Par Value = $100,000 Coupon Rate = 6% Annual Coupon = $100,000 x 6% = $6,000 Coupon Rate Calculator | Bond Coupon Jul 15, 2022 · As this is a semi-annual coupon bond, our annual coupon rate calculator uses coupon frequency of 2. And the annual coupon payment for Bond A is: $25 * 2 = $50. Calculate the coupon rate; The last step is to calculate the coupon rate. You can find it by dividing the annual coupon payment by the face value: coupon rate = annual coupon payment ... How to Calculate Bond Discount Rate: 14 Steps (with Pictures) - wikiHow Calculate the bond discount rate. This tells your the percentage, or rate, at which you are discounting the bond. Divide the amount of the discount by the face value of the bond. Using the above example, divide $36,798 by $500,000. $ 36, 798 / $ 500, 000 = .073596 {\displaystyle \$36,798/\$500,000=.073596} Bond Value Calculator: What It Should Be Trading At | Shows Work! Enter the par (face) value of the bond. Step #2: Enter the bond's coupon rate percentage. Step #3: Select the coupon rate compounding interval. Step #4: Enter the current market rate that a similar bond is selling for. Step #5: Enter the number of years until the bond reaches maturity. Step #6: Click the "Calculate Bond Price" button.

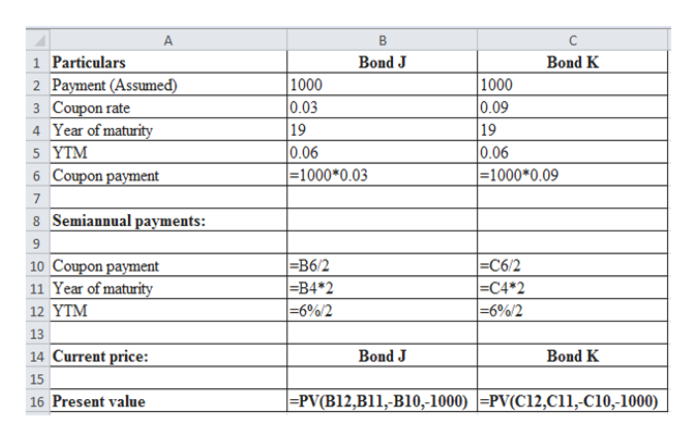

How Can I Calculate a Bond's Coupon Rate in Excel? In cell B2, enter the formula "=A3/B1" to yield the annual coupon rate of your bond in decimal form. Finally, select cell B2 and hit CTRL+SHIFT+% to apply percentage formatting. For example, if a...

What is a Coupon Rate? (with picture) - Smart Capital Mind The coupon rate, also called the coupon, is the yearly interest rate payout on a bond that is communicated as a percentage of the value of the bond. Some bonds, called zero coupon bonds, are issued for less than face value and assigned no coupon rate. Instead of periodic interest payments based on the coupon rate, the higher face value is ...

Coupon Rate of a Bond (Formula, Definition) - WallStreetMojo The coupon rate of a bond can be calculated by dividing the sum of the annual coupon payments by the par value of the bond and multiplied by 100%. Therefore, the rate of a bond can also be seen as the amount of interest paid per year as a percentage of the face value or par value of the bond. Mathematically, it is represented as,

Formula to Calculate Coupon Rate - WallStreetMojo The formula for coupon rate is computed by dividing the sum of the coupon payments paid annually by the par value of the bond and then expressed in terms of percentage. Coupon Rate = Total Annual Coupon Payment / Par Value of Bond * 100% You are free to use this image on your website, templates, etc, Please provide us with an attribution link

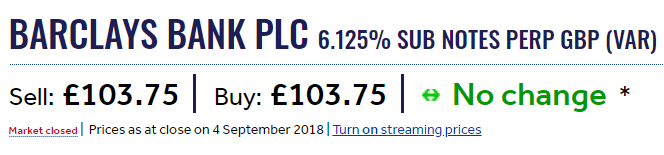

Compare Fixed Rate Bonds | MoneySuperMarket Some fixed rate bond accounts can be opened with as little as £1, for example, but typical minimum deposits start at about £500. Maximum deposits can go into millions, but remember only the first £85,000 will be protected by the FSCS (where applicable).

What Is a Coupon Rate? How To Calculate Them & What They're Used For Let's take a look at the formula for calculating the coupon rate and how we can apply them. Simple Formula C = I/P Where: C = coupon rate I = annualized interest P = par value The coupon rate is the rate by which the bond issuer pays the bondholder.

Bond Basics: Issue Size and Date, Maturity Value, Coupon - The … May 28, 2022 · Coupon and Yield to Maturity . The coupon rate is the periodic interest payment that the issuer makes during the life of the bond. For instance, a bond with a $10,000 maturity value might offer a coupon of 5%. Then, you can expect to receive $500 each year until the bond matures.

Bond Price Calculator | Formula | Chart 20.6.2022 · Bond price is calculated as the present value of the cash flow generated by the bond, namely the coupon payment throughout the life of the bond and the principal payment, or the balloon payment, at the end of the bond's life.You can see how it changes over time in the bond price chart in our calculator. To use bond price equation, you need to input the following data …

Create function in R to find coupon rate for bond Create function in R to find coupon rate for bond. c_rate <- function (bond_value, par, ttm, y) { t <- seq (1, ttm, 1) pv_factor <- 1 / (1 + y)^t cr <- (bond_value - par / (1+y)^t) / (par*sum (pv_factor)) cr } however, this yields multiple results. How can i update the function to only yield one the final index only? In the final line.

What Is Coupon Rate and How Do You Calculate It? To calculate the bond coupon rate we add the total annual payments then divide that by the bond's par value: ($50 + $50) = $100; The bond's coupon rate is 10 percent. This is the portion of its value that it repays investors every year. Bond Coupon Rate vs. Interest. Coupon rate could also be considered a bond's interest rate.

What Is Coupon Rate and How Do You Calculate It? - Accounting Services A bond's coupon rate is expressed as a percentage of its par value. The par value is simply the face value of the bond or the value of the bond as stated by the issuing entity. Thus, a $1,000 bond with a coupon rate of 6% pays $60 in interest annually and a $2,000 bond with a coupon rate of 6% pays $120 in interest annually.

Coupon Rate Formula | Calculator (Excel Template) - EDUCBA Coupon Rate is calculated using the formula given below Coupon Rate = (Annual Coupon (or Interest) Payment / Face Value of Bond) * 100 Coupon Rate = (86.7 / 1000) * 100 Coupon Rate= 8.67% Coupon Rate Formula - Example #3 Tata Capital Financial Services Ltd. Issued secured and unsecured NCDs in Sept 2018. Details of the issue are as following:

What Is the Coupon Rate of a Bond? - The Balance Nov 18, 2021 · The annual interest paid divided by bond par value equals the coupon rate. As an example, let’s say the XYZ corporation issues a 20-year bond with a par value of $1,000 and a 3% coupon rate. Bondholders will receive $30 in interest payments each year, generally paid on a semiannual basis.

Bond Price Calculator n = Coupon rate compounding freq. (n = 1 for Annually, 2 for Semiannually, 4 for Quarterly or 12 for Monthly) r = Market interest rate t = No. of years until maturity After the bond price is determined the tool also checks how the bond should sell in comparison to the other similar bonds on the market by these rules:

Coupon Rate Template - Realonomics If you want to calculate the annual coupon payment for a bond, all you have to do is multiply the bond's face value by its annual coupon rate.That means if you have a bond with a face value of $1000 and an annual coupon rate of 10%, then the annual coupon payment is 10% of $1000, which is $100.

Bond Yield Calculator Bond's coupon rate (interest rate). The equations that the algorithm is based on are: Current bond yield = Annual interest payment / Bond's current clean price; Annual interest payment = Bond's face value * Bond's coupon rate (interest rate) * 0.01. Please remember that the coupon rate is in decimal format thus it should be multiplied ...

Post a Comment for "41 find the coupon rate of a bond"