41 coupon rate of bond calculator

Treasury Return Calculator, With Coupon Reinvestment The calculator assumes bonds are bought at face value with no transaction fees and a tax rate of 0%. Since we only have a 10-year yield number, we had to take some liberties when calculating bond prices - we properly compute dirty and clean prices of the bonds, but we are assuming that bonds are sold at the 7 year mark asking for the 10 year yield. Coupon Rate - Meaning, Calculation and Importance - Scripbox To calculate the couponrate for Company A's bond, we need to know the total annual interest payments. Total Annual Interest Payments = 50 + 50 = 100 Coupon Rate = 100 / 500 * 100 = 20% Therefore, the coupon rate for the Company A bond is 20%. Importance of Coupon Rate in Bonds Bonds pay interest to their holders.

› terms › cCoupon Rate Definition - Investopedia Sep 05, 2021 · Coupon Rate: A coupon rate is the yield paid by a fixed-income security; a fixed-income security's coupon rate is simply just the annual coupon payments paid by the issuer relative to the bond's ...

Coupon rate of bond calculator

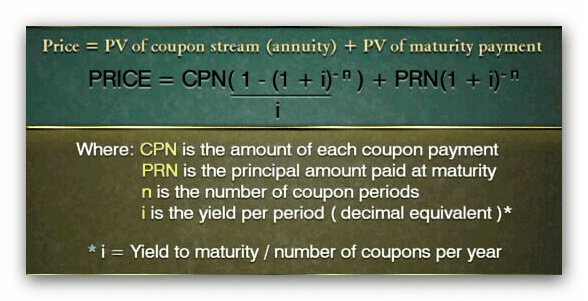

Bond Price Calculator | Formula | Chart coupon per period = face value * coupon rate / frequency As this is an annual bond, the frequency = 1. And the coupon for Bond A is: ($1,000 * 5%) / 1 = $50. Determine the years to maturity. The n is the number of years it takes from the current moment to when the bond matures. The n for Bond A is 10 years. Determine the yield to maturity (YTM). Coupon Rate - Meaning, Example, Types | Yield to Maturity Comparision Step-Up Notes with Increasing Coupon Rate. Another security that has a unique coupon structure is step-up bonds. These are bonds that have a coupon rate that increases over time. For example, a 5-year step-up bond of the par value of USD 100.00 may have a coupon rate of 5% for the first 3 years and 7% for the last two years. Calculating Tax Equivalent Yield on Municipal Bonds Here's how you calculate the TEY in a few steps: Find the reciprocal of your tax rate (1 - your tax rate). If you pay 25% tax, your reciprocal would be (1 - .25) = .75, or 75%. Divide this amount into the yield on the tax-free bond to find out the TEY. For example, if the bond in question yields 3%, use (3.0 / .75) = 4%.

Coupon rate of bond calculator. Zero Coupon Bond Calculator - Calculator Academy Zero Coupon Bond Formula The following formula is used to calculate the value of a zero-coupon bond. ZCBV = F / (1+r)^t where ZCBV is the zero-coupon bond value F is the face value of the bond r is the yield/rate t is the time to maturity Zero Coupon Bond Definition Treasury Bonds | CBK This calculator allows you determine what your payment would be based on the bond's face value, coupon rate, quoted yield and tenor. Treasury/ Infrastructure Bonds Pricing Calculator. Conventional Bonds and Bonds Re-opened on exact interest payment dates. Fixed Coupon Zero Coupon. › finance › coupon-rateCoupon Rate Calculator | Bond Coupon Jan 12, 2022 · As this is a semi-annual coupon bond, our annual coupon rate calculator uses coupon frequency of 2. And the annual coupon payment for Bond A is: $25 * 2 = $50. Calculate the coupon rate; The last step is to calculate the coupon rate. You can find it by dividing the annual coupon payment by the face value: coupon rate = annual coupon payment ... dqydj.com › zero-coupon-bond-calculatorZero Coupon Bond Calculator – What is the Market Price? - DQYDJ P: The par or face value of the zero coupon bond; r: The interest rate of the bond; t: The time to maturity of the bond; Zero Coupon Bond Pricing Example. Let's walk through an example zero coupon bond pricing calculation for the default inputs in the tool. Face value: $1000; Interest Rate: 10%; Time to Maturity: 10 Years, 0 Months ...

How to Perform Bond Valuation with Python | by Bee Guan Teo | Towards ... The price of a bond at the time we purchase it is the present value of all the future streams of payments. For example, there is a bond with a $2000 face value which will pay a coupon rate of 8% once per year. If the bond will be matured in 5 years and the annual compound interest rate is 6% for all loan terms, what is the price of the bond? Bond Pricing - Formula, How to Calculate a Bond's Price A coupon is stated as a nominal percentage of the par value (principal amount) of the bond. Each coupon is redeemable per period for that percentage. For example, a 10% coupon on a $1000 par bond is redeemable each period. A bond may also come with no coupon. In this case, the bond is known as a zero-coupon bond. Bond Pricing | Valuation | Formula | How to calculate with example | eFM Example 2. Calculate the price of a bond whose face value is $1000. The coupon rate is 10% and will mature after 5 years. The required rate of return is 8%. Coupon payment every year is $1000*10% = $100 every year for a period of 5 years. Hence, Therefore, the value of the bond (V) = $1079.8. Bond Valuation: Formula, Steps & Examples - Study.com Bond Terms. Horse Rocket Software has issued a five-year bond with a face value of $1,000 and a 10% coupon rate. Interest is paid annually. Similar bonds in the market have a discount rate of 12%.

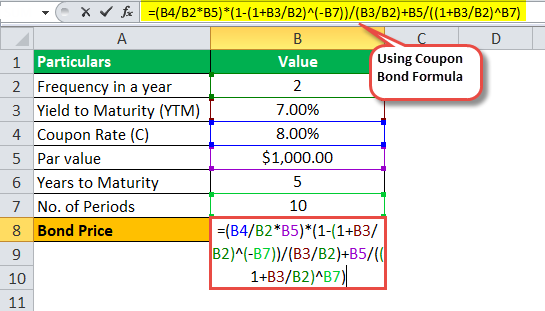

Coupon Rate Calculator | Calculate Coupon Rate - AZCalculator This calculator calculates the coupon rate using face value, coupon payment values. Bond Dirty Price Calculator - CALCULATOR RUT - Blogger Dirty price is the present value of future coupon payments and maturity value of the bond determined using the following formula: Yield to maturity % face value $ coupon rate % payments per year. To calculate a bond's dirty price, simply add the quoted price and the accrued interest, which is another calculation altogether. I Bonds Rates Will Increase To 9.62% (May 2022 Update) Ninja Update 4/29/22: I Bonds purchased now will count as May purchases and immediately get the 9.62% rate. Purchases no longer gets the 7.12% + 9.62%. Instead you'll get the 9.62% rate for 6 months and then an unknown rate for the following 6 months. This is still a great opportunity to lock in a high return with zero risks. How to Calculate Bond Price in Excel (4 Simple Ways) 🔄 Semi-Annual Coupon Bond In cell K10 insert the following formula. =PV (K8/2,K7,K5*K9/2,K5) In the formula, rate = K8/2 (as it's a semi-annual bond price), nper = K7, pmt = K5*K9/2, [fv] = K5. After executing the respective formulas, you can find different bond prices as depicted in the latter screenshot.

What is a Coupon Rate? (with picture) - Smart Capital Mind The coupon rate, also called the coupon, is the yearly interest rate payout on a bond that is communicated as a percentage of the value of the bond. Some bonds, called zero coupon bonds, are issued for less than face value and assigned no coupon rate. Instead of periodic interest payments based on the coupon rate, the higher face value is ...

Quant Bonds - Between Coupon Dates - BetterSolutions.com Quant Bonds - Between Coupon Dates Yield Between Coupon Dates There are several ways you can calculate the yield to maturity for dates that fall between coupon dates: 1) Using the IRR function 2) Using the YIELD function 3) Using the XIRR function 4) Using the Secant Method 5) Using the Bisection Method 6) Using the Newton Raphson Assumptions

Understanding Coupon Rate and Yield to Maturity of Bonds To translate this to quarterly payment, first, multiply the coupon rate net of 20% final withholding taxes by the face value (1.900% x 1,000,000). Then, divide the resulting annual amount by 4. Here's a sample of how you can compute your expected coupon income from your bond: Php 4,750.00 is the income you can expect to receive quarterly.

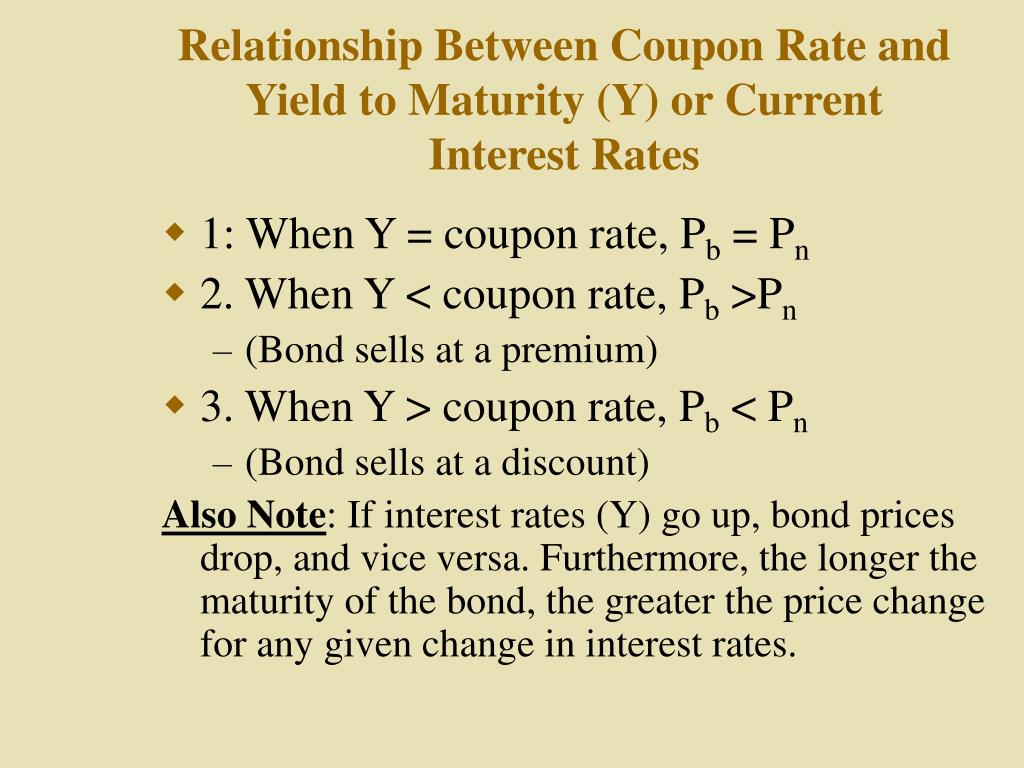

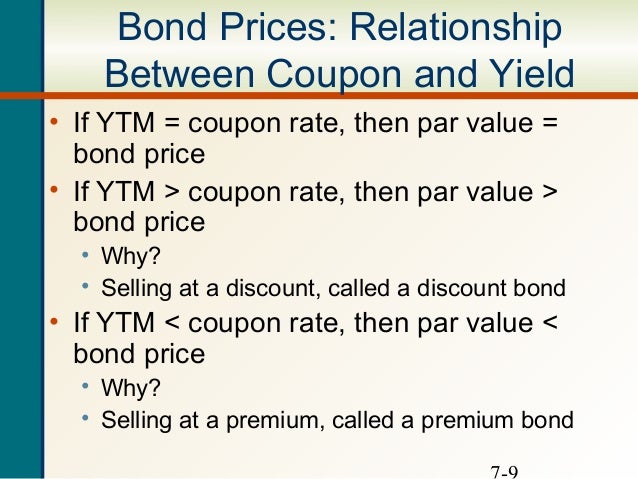

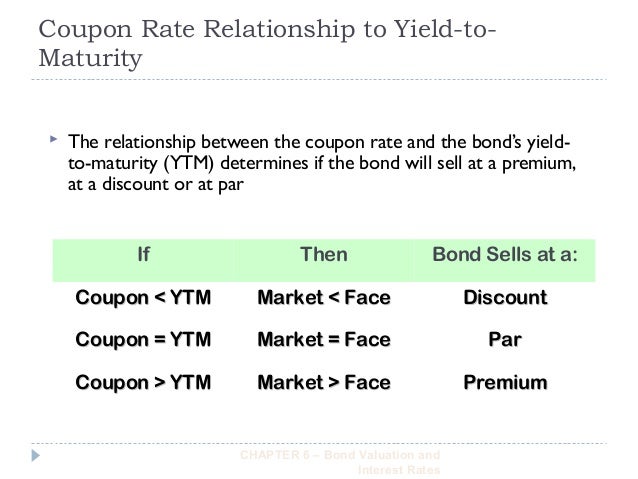

› coupon-rate-formulaCoupon Rate Formula | Calculator (Excel Template) - EDUCBA Coupon Rate = (20 / 100) * 100; Coupon Rate = 20% Now, if the market rate of interest is lower than 20% than the bond will be traded at a premium as this bond gives more value to the investors compared to other fixed income securities.

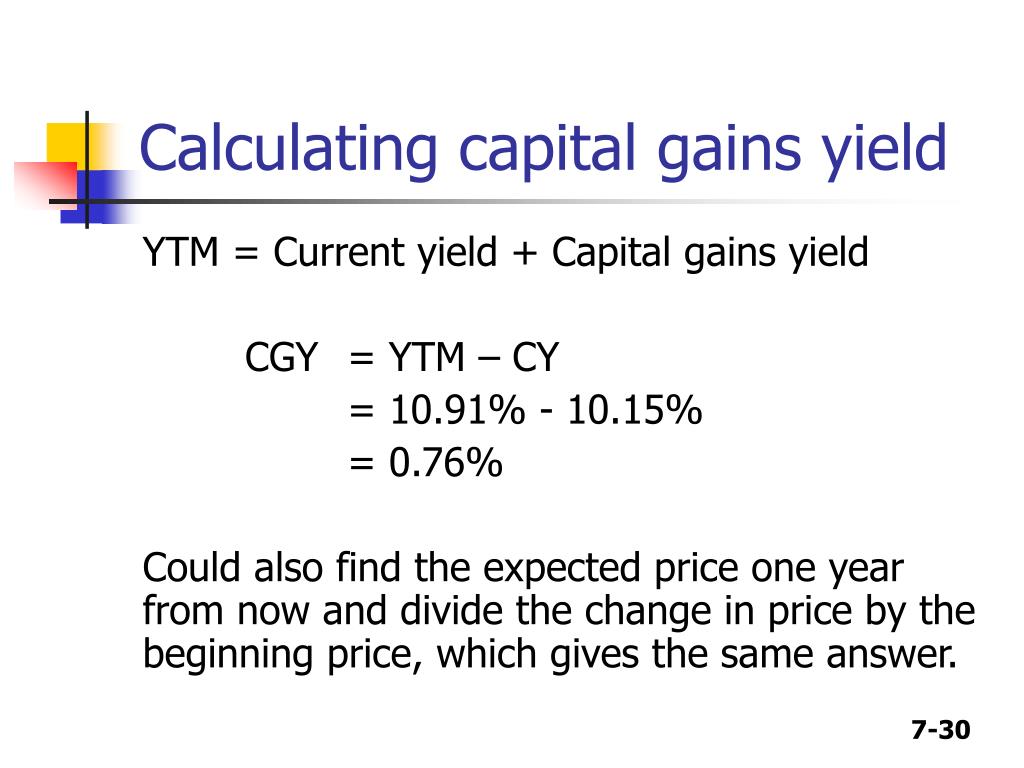

Basics Of Bonds - Maturity, Coupons And Yield Current yield is the bond's coupon yield divided by its market price. To calculate the current yield for a bond with a coupon yield of 4.5 percent trading at 103 ($1,030), divide 4.5 by 103 and multiply the total by 100. You get a current yield of 4.37 percent. Say you check the bond's price later and it's trading at 101 ($1,010).

Coupon Rate: Definition, Formula & Calculation - Study.com The coupon rate of ten percent is fixed because it is based on the par value, or face value, of the bond. However, it is important to note that if the price of bond changes, the yield will change....

› Zero_Coupon_Bond_ValueZero Coupon Bond Value - Formula (with Calculator) After 5 years, the bond could then be redeemed for the $100 face value. Example of Zero Coupon Bond Formula with Rate Changes. A 6 year bond was originally issued one year ago with a face value of $100 and a rate of 6%. As the prior example shows, the value at the 6% rate with 5 years remaining would be $74.73.

dqydj.com › bond-pricing-calculatorBond Price Calculator – Present Value of Future Cashflows - DQYDJ The bond pricing calculator shows the price of a bond from coupon rate, market rate, and present value of payouts. Plus dirty & clean bond price formulas.

Quant Bonds - Between Coupon Dates - BetterSolutions.com A corporate bond has a 10% coupon and a maturity date of 1 March 2020. It has a current dirty price if £118.78 The settlement date is 17 July 2014 SS - excel settlement date maturity date frequency - 2 semi-annual Day Convention / Basis Coupon Rate Coupon Days Accrued Number of Days in Period Quoted Dirty Price Accrued Interest Clean Price

How Can I Calculate a Bond's Coupon Rate in Excel? In cell B2, enter the formula "=A3/B1" to yield the annual coupon rate of your bond in decimal form. Finally, select cell B2 and hit CTRL+SHIFT+% to apply percentage formatting. For example, if a...

I Bonds Rate Calculator - B Mindy Rivera To calculate the coupon per period you will need two inputs namely the coupon rate and frequency. The Interest Rate Calculator determines real interest rates on loans with fixed terms and monthly payments. If you are considering investing in a bond and the quoted price is 9350 enter a 0 for yield-to-maturity.

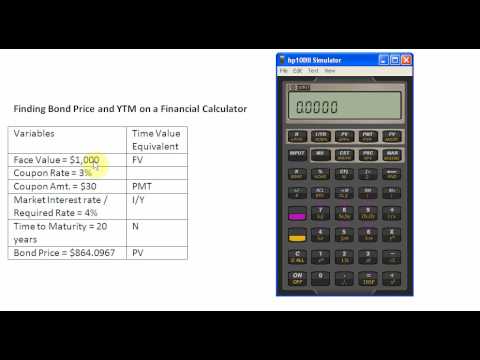

How To Calculate YTM (Years To Maturity) On A Financial Calculator YTM = [ (Face Value - Market Price) / Market Price] * [1 / Years to Maturity] - 1 + [Coupon Rate / 2] For example, let's say that Johnnie's bond has a face value of $1,000, a market price of $950, a coupon rate of 5%, and 20 years until maturity. Plugging those numbers into the equation above would give us a YTM of 4.76%.

› what-is-the-coupon-rate-of-aWhat Is the Coupon Rate of a Bond? - The Balance Nov 18, 2021 · The annual interest paid divided by bond par value equals the coupon rate. As an example, let’s say the XYZ corporation issues a 20-year bond with a par value of $1,000 and a 3% coupon rate. Bondholders will receive $30 in interest payments each year, generally paid on a semiannual basis.

Coupon Rate - Learn How Coupon Rate Affects Bond Pricing until maturity when the bondholder's initial investment - the face value (or "par value") of the bond - is returned to the bondholder. Formula for Calculating the Coupon Rate Where: C = Coupon rate i = Annualized interest P = Par value, or principal amount, of the bond Download the Free Template

I Bonds Rates Calculator - Blogger The bond valuation calculator follows the steps below. Youll get an average rate of 837. But the inflation rate could increase if inflation picks. Also enter the settlement date maturity date and coupon rate to calculate an accurate yield. You can access the rate information from the official Treasury Direct website.

Calculating Tax Equivalent Yield on Municipal Bonds Here's how you calculate the TEY in a few steps: Find the reciprocal of your tax rate (1 - your tax rate). If you pay 25% tax, your reciprocal would be (1 - .25) = .75, or 75%. Divide this amount into the yield on the tax-free bond to find out the TEY. For example, if the bond in question yields 3%, use (3.0 / .75) = 4%.

Coupon Rate - Meaning, Example, Types | Yield to Maturity Comparision Step-Up Notes with Increasing Coupon Rate. Another security that has a unique coupon structure is step-up bonds. These are bonds that have a coupon rate that increases over time. For example, a 5-year step-up bond of the par value of USD 100.00 may have a coupon rate of 5% for the first 3 years and 7% for the last two years.

Post a Comment for "41 coupon rate of bond calculator"