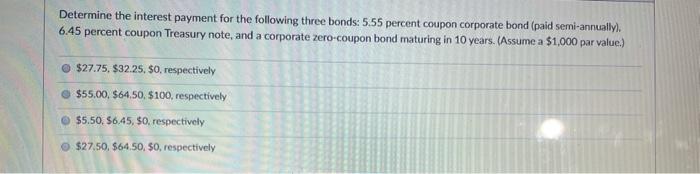

43 zero coupon bond value calculator

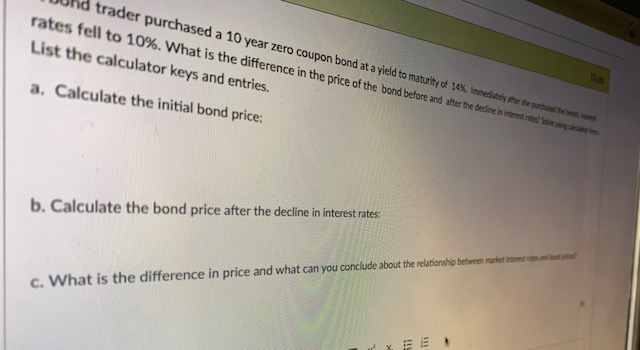

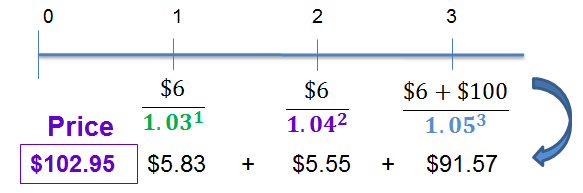

EGP T-Bonds EGP T-Bonds Zero Coupon; Deposits (OMO) Fixed Rate Deposits; Variable Rate Deposits; Corridor Linked Deposits; Repo. Fixed Rate Repo; ... EGP Treasury Coupon Bonds Auctions According to the Primary Dealers System. Type Tenor (years) Value (EGP mio) Issue Date Maturity Date Submission Deadline(11 A.M) T.Bonds: 5: 750: 31/05/2022: 05/04/2027 ... Understanding Bond Yields and the Yield Curve #Bonds #YieldCurve # ... The reverse is true if you buy a bond at a premium (more than its face value). Its value at maturity would be less than you paid for it, which would affect your yield. If you paid $960 for a $1,000 bond and held it to maturity, you would receive the full $1,000 principal. That $40 profit is included in the calculation of a bond's yield to maturity.

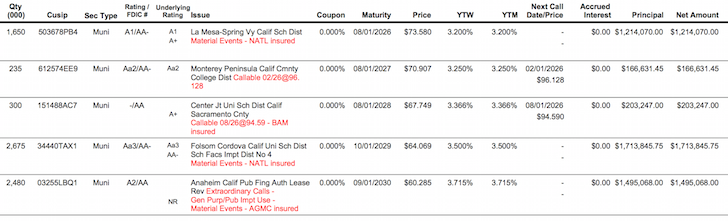

Municipal Bonds | Tax-Advantaged Strategies | PIMCO One of the first municipal interval funds in the industry, the PIMCO Flexible Municipal Income Fund ("MuniFlex") aims to deliver higher after-tax yield than traditional municipal strategies. Overall Morningstar Rating™ among 41 funds. Based on risk-adjusted returns as of 04/30/2022.

Zero coupon bond value calculator

Zero Coupon 2025 Fund | American Century Investments Zero Coupon 2025 Fund. Zero Coupon 2025 Fund Individual Investor. Corporate; Investor Using Outside Advisor ... EOF I provided the others since they give necessary information. Zimmer ... Zimmer Corp. bonds are rated BBB, pay coupon interest of $120 per year, and have 10 years to maturity. The face value of the bond is $1,000. If the yield for similar bonds is currently 12%, what is the bond's current market value (B0)? 1,000.00 2. For the Zimmer Corp bond described in Problem 1, find the bond's value if the yield for ...

Zero coupon bond value calculator. Iifl Home Finance Ltd 10% - Bond - ICICI Direct 8.95 % Coupon rate 10% Face Value 1,000 Maturity date 03-Nov-2028 Last Traded Price 1,004.77 Last Traded Date 02-May-2022 Key Metrics Nature of bond Unsecured Coupon Frequency Yearly Issue Size (in crs.) 232.72 Time till maturity 6y 6m 0d Ex-Date 03-Nov-2022 Issue date 03-Aug-2021 Coupon Structure Fixed OTHER BONDS ISSUED BY COMPANY JOHNSON & JOHNSONLS-NOTES 2007(07/24) Bond - Insider The Johnson & Johnson-Bond has a maturity date of 11/6/2024 and offers a coupon of 5.5000%. The payment of the coupon will take place 1.0 times per Year on the 06.11.. How to Invest in Bonds: A Beginner's Guide to Buying Bonds For example, if you buy $10,000 worth of bonds at face value -- meaning you paid $10,000 -- then sell them for $11,000 when their market value increases, you can pocket the $1,000 difference. Bond ... calculate the 2 year 3 year and 4 year zero coupon yields and discount ... calculate the 2 year 3 year and 4 year zero coupon yields and discount factors consi 600427 ... 3-year and 4-year zero-coupon yields and discount factors consistent with the following bonds. The 1-year yield is 10.00%. Maturity. Coupon. Price. 2 years. 9.0% (annual) 97.70. 3 years. 7.0% (annual) 90.90.

What are Baby Bonds? | Learn More | Investment U By comparison, institutional bond par values are as follows: Corporate bonds traditionally sell for $1,000 par values Municipal bonds generally have a $5,000 face value Federal bonds can have par values as high as $10,000 Baby bonds can range from as low as $25 up to $1,000, with most coming in denominations of $100. How To Find P(x) On Ti 84 - CALUTAR Finding A Z Critical Value On A Ti 84 Graphing Calculators Ap Statistics Math Help . ... How To Calculate Yield To Maturity Of Zero Coupon Bond In Excel YIELDB6B7B4B13B3B10B11 and you will find that the YTM is 9… How To Put An Equal Sign On Ti-83 Plus You usually want to set. Plus sign minus - number decimal … US Treasury Zero-Coupon Yield Curve - NASDAQ - Datastore US Treasury Zero-Coupon Yield Curve From the data product: US Federal Reserve Data Releases (60,282 datasets) Refreshed an hour ago, on 24 May 2022 Frequency daily Description These yield curves... Solved Variable Name Options Are Bond Semiannual Coupo The coupon rate of a bond can be calculated by dividing the sum of the annual coupon payments by the par value of the bond and multiplied by 100%. therefore, the rate of a bond can also be seen as the amount of interest paid per year as a percentage of the face value or par value of the bond. mathematically, it is represented as, coupon rate.

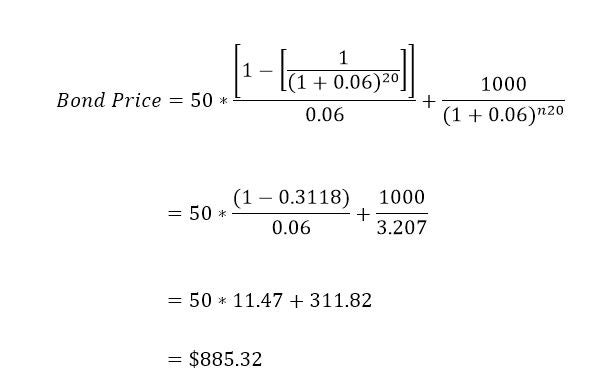

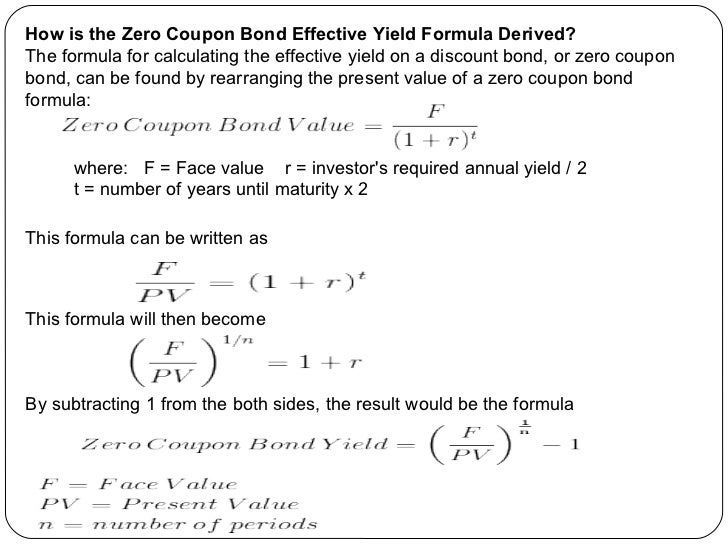

Perù Government Bonds - Yields Curve Click on the " Compare " button, for a report with the full comparison between the two countries, with all the available data. Perù Government Bonds Prices Price Simulation: bonds with a face value of 100, with different coupon rates. The highlighted column refers to the zero coupon bond. Click on for a forecast of the yield. 8) Variable-Rate Bonds Are variable-rate bonds attractive What is the price you should be willing to pay for this bond?12) Bond Valuation You are interested in buying a $1,000 par value bond with 10 years to maturity and an 8 percent coupon rate that is paid semiannually. How much should you be willing to pay for the bond if the investor's required rate of return is 10 percent? Muthoot Fincorp Limited -% - Bond - ICICI Direct 9.58 % Coupon rate - Face Value 1,000 Maturity date 02-Feb-2028 Last Traded Price 1,014.00 Last Traded Date 27-May-2022 Key Metrics Nature of bond Secured Coupon Frequency -- Issue Size (in crs.) 8.26 Time till maturity 5y 8m 4d Issue date 02-Feb-2022 Coupon Structure Zero Coupon OTHER BONDS ISSUED BY COMPANY Bond Valuation Zero-coupon bonds: A corporation promises to pay a specified amount (typically $1,000) at a future date. This is the face value of the bond. Investors will buy this bond from the corporation at the present value of this one future payment. The present value of a zero coupon bond can be found using the present value formula.

I provided the others since they give necessary information. Zimmer ... Zimmer Corp. bonds are rated BBB, pay coupon interest of $120 per year, and have 10 years to maturity. The face value of the bond is $1,000. If the yield for similar bonds is currently 12%, what is the bond's current market value (B0)? 1,000.00 2. For the Zimmer Corp bond described in Problem 1, find the bond's value if the yield for ...

EOF

Zero Coupon 2025 Fund | American Century Investments Zero Coupon 2025 Fund. Zero Coupon 2025 Fund Individual Investor. Corporate; Investor Using Outside Advisor ...

Zero coupon bond yield to maturity calculator 778066-Coupon bond yield to maturity calculator

Post a Comment for "43 zero coupon bond value calculator"